AI marks a new chapter for the battery industry

From lab to factory, AI is changing the rules.

This article is brought to you in partnership with SES AI

Summary

The Battery Industry’s Next Competitive Edge: Intelligence

Battery Industry Pulse: Weekly Roundup.

Welcome back to another edition of my newsletter! - Week 29 2025

We've all heard of ChatGPT. You might even use it daily at work or at home.

When ChatGPT arrived, it accelerated the way people use AI. Suddenly, people use it to write code, start companies, and pass exams. That wasn't hype. It was real progress.

AI is already being used in the battery industry. But it hasn't had a moment like ChatGPT yet. It's close, though.

AI quietly changes how batteries are developed, tested, and managed in labs, factories, and battery systems. These are practical improvements.

Battery innovation started with hardware. Then came software. Now the industry is moving into a third phase: applying useful AI throughout the whole process.

AI tools for battery research and development keep getting better. The industry is at a turning point. The real question isn’t whether AI can replace humans. It’s whether people are ready to work alongside AI.

Accelerating Research in Smarter Labs

Battery research traditionally spans decades. LG Energy Solution, for example, dedicated 18 years to LMR chemistry from the first patent in 2010 to the future commercialization in 2028.

AI can speed things up significantly.

Scientists now use AI-driven tools like graph neural networks and quantum simulations to test materials virtually. These models predict key metrics like energy density, conductivity, and heat performance before physical tests even begin.

It's similar to the pharmaceutical industry. AI helps drug companies model molecules and run virtual tests, speeding up discoveries. Battery research is headed the same way.

In 2022, Volkswagen announced a collaboration with Canadian quantum computing company Xanadu. They aimed to use quantum simulations to screen battery materials and identify safer, lighter, and more efficient options.

AI-powered tools are already changing how battery research gets done:

Suggest new electrolytes or cathodes based on target specs.

Predict material performance.

Improve predictions as new data arrives.

Battery companies and labs are seeing real results.

For example, LG Energy Solution cut its cell design process from weeks down to a single day, using AI trained on over 100,000 past designs.

Meanwhile, researchers from MIT, Stanford, and Toyota Research Institute built a model that predicts battery lifespan after just five charge cycles. It sorted cells into short- and long-life groups with 95% accuracy.

These approaches cut both the time and cost of developing new battery designs. They help chemists work faster and more efficiently, without replacing them.

Making Gigafactories More Resilient

Gigafactories face high scrap rates and delicate processes at launch. AI helps make these factories efficient and more adaptable.

Intelligent systems now manage production parameters like slurry viscosity, coating thickness, and drying times in real time. They learn from each batch produced.

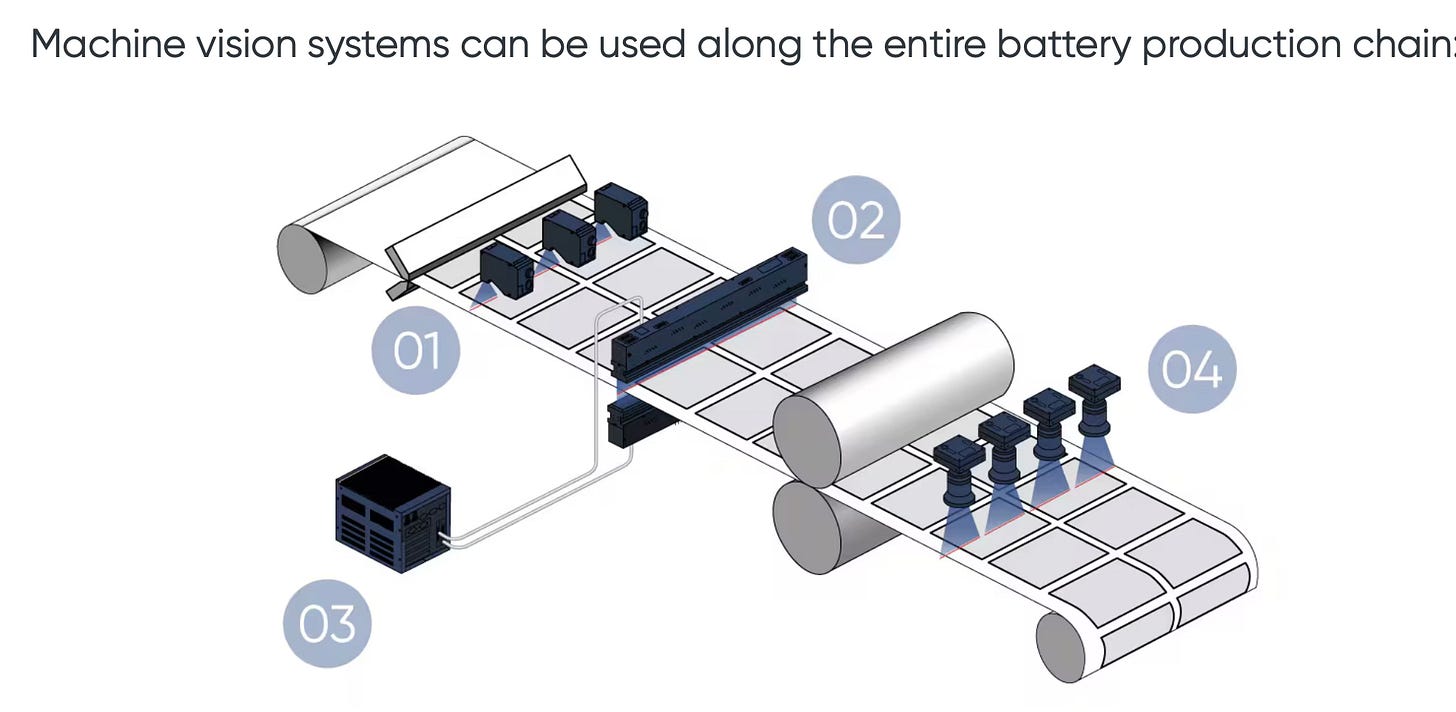

Machine and computer vision systems identify defects instantly. If something is wrong, such as a misplaced screw or missing tab, the system spots it and takes action.

Leading manufacturers are already applying AI across their production lines:

CATL’s Liyang plant uses an AI-powered energy management platform to fine-tune operations. The result is a 16% boost in workshop energy efficiency and a 47% cut in unit energy consumption.

For quality control, CATL combines 3D cameras, AI, and edge computing to inspect welds in real time. Its system now detects 100% of defects in the seal pin welding process and replaces the need for helium leak testing. Defect rates improved from DPPM (defects per million) to DPPB (defects per billion) levels.

Digital twins can reduce commissioning time up to 30 %, according to Siemens.

These factories go beyond automation by continuously improving their processes.

Next-Generation Battery Management Systems (BMS)

Every battery pack includes a BMS.

Traditionally, BMS used fixed rules such as cutting voltage at certain points or reducing current at specific temperatures. But real-world use varies widely, making fixed rules less effective.

AI-powered BMS platforms learn from actual usage data. They predict faults early using machine learning models, adapt charging behavior through predictive analytics, and extend battery life.

With advanced sensors feeding data in real time, these systems can detect issues like overheating before they become dangerous.

Edge-based AI runs directly on the battery pack, not in the cloud. That means faster decisions and real-time response.

Now, the BMS makes decisions rather than just monitoring.

What AI Needs to Succeed

AI only works when you have the right support:

High-quality data from labs, factories, and actual use.

Realistic simulation tools.

Teams skilled in chemistry, physics, and data analysis.

Validation systems to ensure safety and accuracy.

SES AI is one company quietly putting these pieces together.

The company was founded in 2012 and is headquartered in Boston (with operations in Singapore, Shanghai, and Seoul). Initially known for lithium-metal batteries, SES is now building its entire battery development around AI.

SES focuses on:

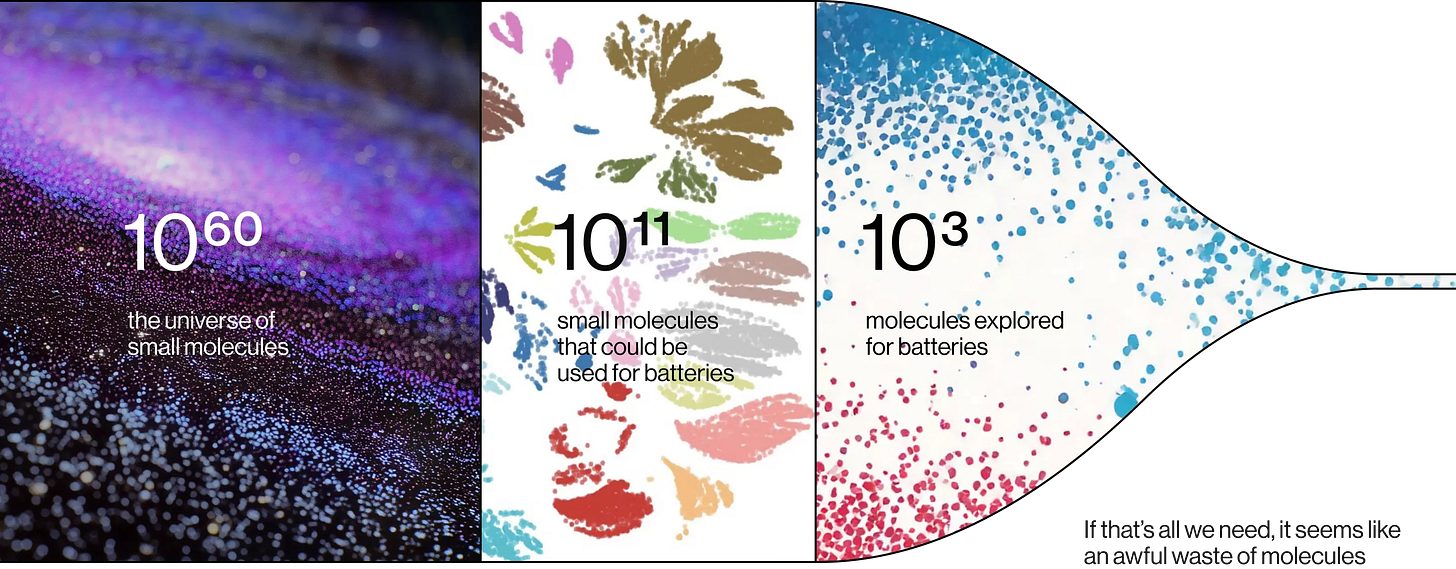

AI for Science: Mapping the molecular universe to discover next-generation materials. The AI system is screening over 100 million molecules. Recently, they developed a new AI-enhanced 2170 cylindrical cell for emerging humanoid robotics applications. It's the first battery that uses an electrolyte discovered by SES AI’s Molecular Universe.

AI for Manufacturing: Analysing manufacturing data to ensure quality and safety. Most battery manufacturers only scan about 5% of cells using CT or X-ray, due to cost and time limits. That leaves 95% of cells unchecked for internal defects. AI can bridge this gap by learning from the 5% and predicting quality issues across the rest

AI for Safety: Predicting battery incidents to ensure nearly 100% battery safety in the field.

SES aims to connect research and production through shared data loops. It now licenses its AI tools, allowing partners to apply what SES has built.

The company continues to develop both its battery cells and electrolyte capabilities.

In addition to delivering high-energy-density batteries for drones, it runs a six-month cycle of producing different cell chemistries. The goal is to collect real-world performance data that can strengthen and refine its AI training models.

At the same time, in-house electrolyte production supports their vertical integration strategy.

I spoke with Dr. Qichao Hu, founder and CEO of SES AI, and asked him a few questions.

What prevents a major OEM or battery maker from building their own AI tools? And if they do, how confident are you that SES can maintain a competitive edge?

We have seen many times that major OEM/battery makers fail at AI due to three main reasons:

a. Lack of data: it’s hard to believe that large OEMs/battery makers lack data. The fact is they do. Large OEM/battery makers have a large amount of commercial-scale manufacturing data, mainly homogeneous chemistry, cell design, >99.99% quality yield. Such data are too homogeneous to be useful for AI model training, the optimal AI model training needs the opposite, diverse chemistry, cell design, ~40% quality yield (good balance of positive and negative signals, AI literally learns from its failures more than success). Most large OEM/battery makers have internal initiatives to build their own AI tools, but all suffer from the same issue, they lack diverse and good quality and well-labeled data, most of them don’t even have a dedicated line to build and test new materials and cells to collect data to train AI models.

b. Lack of focus: major OEMs/battery makers at their DNA are manufacturing companies, their R&D teams are often driven to troubleshoot manufacturing and engineering issues, instead of computation chemistry algorithm development or AI model training, this lack of focus results in often slow progress of AI.

c. Company management culture: AI model training requires cross-department collaboration including materials R&D, AI model team, cell assembly team, cell quality team, cell test team, material synthesis team, formulation synthesis team, IT department, etc. The bigger the company, the harder it is. Most large OEMs/battery makers have given up AI model training primarily because of entrenched barriers in old culture, and resort to collaborating with or acquiring external companies.

SES develops batteries, electrolytes, and AI platforms under one roof. What advantages does that integration unlock in terms of speed, learning, or control that software-only or cell-focused companies can’t replicate?

Software-only: these companies lack high quality data, as a result their models are not accurate. Also customers don’t want just a software, they want a complete solution, a new material or cell design that actually achieve solve their challenges.

Cell-focused: these companies compete on scale and cost, without material discovery software platform it’s hard for one to out-innovate others.

By integrating batteries, electrolytes, and AI platform, we can accelerate material discovery from years to just tens of minutes. And since we have real material and cell data, we can ensure our AI predictions are as accurate as real measurements, and provide actual solutions, not just answers to curiosities. AI is moving from chatbot to agentic problem solvers.

Looking ahead, how do you see AI transforming the battery industry, from cell design to manufacturing and real-world monitoring?

Ultimately, it would be job reduction for human scientists and engineers. Let’s face it, human beings are flawed, they are not that smart, they get tired, they don’t have the full picture, and sometimes they take things personal. In comparison, Agents work 24/7, are trained on everything humans are trained with perfect memory and much more, have the full picture, and don't take things personal, Agents would be simply more efficient at workplace than human beings.

In battery manufacturing, we have already seen the benefit of automation. We expect Agents to automate R&D, and the entire battery development process from R&D to manufacturing will be human-free.

Better Chemistry Through Better Data

In the past, battery breakthroughs came from better chemistry. Soon, they'll come from better data.

AI doesn't replace chemistry. It enhances it. It shortens development cycles, reduces factory waste, and boosts safety and battery lifespan.

The real competitive edge won't be about having the best chemistry.

It will be about who learns fastest and able to find the best materials and its commercial use case faster.

Now, let’s look at this week's battery market developments.

Battery Industry Pulse: Weekly Roundup

Metals

Battery Material Stocks Jump after US Announces Graphite Duty

Mangrove’s new lithium plant will boost North America’s EV game

SK on secures Korean lithium hydroxide for U.S. battery push

Components

Battery

BHP explores opportunities with BYD in battery electrification

LG Energy to supply CTP pouch batteries for Renault EVs next year

Ultium Cells to upgrade Tennessee plant for low-cost EV battery cell production

BESS

Battery recycling

Passengers Cars

🤝 For newsletter sponsorships - Click here

🤳 I am also present on LinkedIn - Click here

Wonderful article Christopher. AI is just a prediction tool. It will replace some battery scientists who do predictive lab experiments but humans will always be needed to make judgements.

When CEO of SES reports that he needs positive and negative battery data for his AI agent, he means it. They are the only non Chinese battery company that advertises its testing bunker online.

I would love to see an article on Lithium Metal Anode batteries. They require vapor deposition technology to coat Lithium less than a hair’s thickness on copper foil. An interesting company doing this is Elevated Matériels which is offspring of parent company Applied Materials.

Interesting that SES is using an AI focused version of vertical R&D.

Related: I think the best application for these newer generations of batteries are drones, cellphones, and other shorter lived consumer devices. A car is such a large purchase, by comparison, that customer conservativism on technology is necessary. I don't want to spend $50k on a car only to have it brick 2-3 years later due to some issue on the learning curve of a new chemistry. It is better to accept 10% lower performance on a car in exchange for known durability. I'll take a risk on my phone or drone!