Beyond Lithium: Unveiling the Promise of Sodium-Ion Batteries

Every week, the battery landscape shifts in fascinating ways — this one is no different.

Welcome back to another edition of my newsletter! - Week 13 2025

This week, I’ll be discussing about sodium-ion batteries. These batteries could be an interesting alternative to lithium-ion batteries for very specific applications. Sodium-ion batteries gained significant interest from the battery industry in 2022 due to the rising lithium prices.

Summary

Special topic: Sodium-ion batteries: current status and future outlook

Battery Industry Pulse: Weekly Roundup.

Special Topic: sodium-ion batteries: current status and future outlook.

Sodium-ion batteries are considered one of the most promising alternatives to lithium-ion batteries.

Sodium-ion development dates back to the 1970s and early 1980s. However, in the 1990s, lithium-ion batteries showed more commercial promise, causing a decline in interest in sodium-ion.

Industry interest in sodium-ion batteries surged during the 2022 lithium price spike.

Sodium-ion batteries operate similarly to lithium-ion batteries. They use sodium ions instead of lithium ions during charge and discharge cycles.

Sodium is significantly more abundant than lithium. It’s over 1000 times more abundant than lithium. It can be sourced from deposits in the earth's crust and saltwater.

Main components

Like lithium-ion batteries, sodium-ion batteries include a cathode (sodium-based), an anode, and an electrolyte.

The anode is typically made from hard carbon.

Instead of using copper as the current collector, aluminum is lighter and more affordable.

Main cathodes

There are 3 main cathodes types for sodium-ion batteries:

Layered Transition Metal Oxides: These are made from metals (like manganese, iron, or nickel) and oxygen arranged in layers. This layered structure makes it easy for sodium ions to slide in and out.

Advantages: High theoretical capacity, moderate cost, and easy to produce.

Cons: Air/moisture sensitivity, some formulas rely on pricey metals (cobalt).

Polyanionic compounds: Polyanion‐type compounds are among the most promising electrode materials for Na‐ion batteries due to their stability, safety, and suitable operating voltages. It includes materials such as sodium iron phosphate (NaFePO4), sodium vanadium phosphate (Na3V2(PO4)3), and sodium ferric phosphate pyrophosphate (Source: Ni Q, Bai Y, Wu F, Wu C. Polyanion-Type Electrode Materials for Sodium-Ion Batteries).

Advantages: High thermal stability, and excellent cycle life.

Cons: low energy density and lower conductivity, high cost.

Prussian blue analogues (PBA): known as iron cyanides or ferrocyanides, are a group of compounds that are structurally related to Prussian blue. Like Prussian blue, these compounds are made by reacting iron salts with cyanide compounds. (Source: Macsen Labs). PBAs have attracted tremendous attention because their open framework structure could easily accommodate Na+ and enable its fast transportation.

Advantages: low cost, fast charging.

Cons: energy density can vary and may be lower than layered oxides and water content can affect performance consistency and cycle life.

Current market

As of 2025, sodium-ion batteries are in the early stages of commercialization.

Sodium-ion batteries are mainly used in the ESS market and micro-mobility. But, still in limited number. For example, China’s state-owned power generation enterprise Datang Group connected to the grid a 50 MW/100 MWh project in Qianjiang, Hubei Province, in 2024, making it the world’s largest operating sodium-ion battery energy storage system. For lithium-ion batteries, we are talking about GWh for the ESS market.

The presence of sodium-ion batteries in the EV market is only at the test level. Hina and Farasis already provided sodium-ion batteries for EVs in China. The EV segment is exclusively A00-class in China. It’s the smallest segment. The sodium-ion batteries have a weakness. The low energy density (max 160-165 Wh/kg) limits its broader EV potential.

Only a few GWh of sodium-ion batteries are produced annually at the moment (Source: IdTechEx).

Forecasts

Several projects were announced when the sodium-ion battery hype happened in 2022 (when lithium price was very high). Since then, some projects have been canceled.

The long-term forecast figures vary according to consultants:

Benchmark Minerals Intelligence is the most bullish consultant with tracking 335.4 GWh of sodium ion cell production capacity out to 2030 (Data from PV magazine in March 2024)

WoodMackenzie forecasts around 40 GWh of base case Na-ion cell production capacity by 2030. “A further 100 GWh of production capacity is possible if Na-ion cells see success by 2025” (February 2023).

The International Energy Agency (IEA) predicts sodium-ion batteries will account for around 10% of annual energy storage additions globally by 2030 and grow further beyond that.

IdTechEx forecasts that global Na-ion production capacity could exceed 100 GWh by 2030. (March 2025).

McKinsey predicts sodium-ion batteries will account for 9% of the total battery demand by 2030 (source: Battery Show Europe 2024).

Please take these figures with a grain of salt as they are not all up to date. The battery industry, especially lithium-ion, is very dynamic, with the EV and ESS market evolving fast. The forecasts can be obsolete very quickly.

But, they all agree that China will dominate the market with 90% of the world’s production capacity by 2030.

Main Players (List non-exhaustive)

Several players are working and producing sodium-ion batteries. The degrees of production vary a lot.

China

China is, again, the most active country in the sodium-ion battery industry. The country produces sodium-ion batteries on a large scale.

CATL: In 2021, CATL announced its first-generation battery boasting 160 Wh/kg energy density with charging to 80% in 15 minutes.

Now, CATL is working on its second-generation sodium-ion battery. The performance is now approaching LFP battery levels. The energy density should exceed 200 Wh/kg, a substantial increase from the 160 Wh/kg of the first generation.

"Once large-scale adoption is achieved, sodium-ion batteries will have a certain cost advantage over LFP batteries," the company stated.

Type of sodium-ion batteries: Prussian white

BYD: In January 2024, BYD started construction of a 30 GWh sodium-ion battery plant in Xuzhou, China, with plans to use SIBs in EVs and energy storage systems. BYD is investing $1.4 billion in this facility.

Type of sodium-ion batteries: Layered Oxides + Polyanionic

Hina: The Chinese company became the 1st battery maker to put sodium-ion batteries in EVs in China in 2023. They have the world's first GWh-class sodium-ion battery production line (1 GWh then 5 GWh annual capacity). According to their Industrial roadmap, they should have a total of 10 GWh annual production capacity by now.

Type of sodium-ion batteries: Layered oxides

Farasis: The Chinese battery maker was one of the first with Hina to power an EV with sodium-ion batteries. The JMEV EV3 is powered by Farasis sodium-ion batteries. The energy density is around 140 to 160 Wh/ kg. Farasis Energy is projected to have an energy density of 160-180 Wh/ kg for 2nd gen.

Type of sodium-ion batteries: Layered oxides

Zoolnasm: Zoolnasm begins construction of its 1st production base in Nov 2023. The planned annual capacity includes 20 GWh of sodium-ion battery cells and 10 GWh of sodium-ion battery systems.

Type of sodium-ion batteries: Polyanionic Sodium Iron Sulfate

North America

One company that is very active in North America is Natron Energy. In 2024, Natron announced the first sodium-ion battery gigafactory in the United States, a $1.4 billion investment.

The facility will be located in Edgecombe County, NC, USA, and is expected to produce 24GW of Natron’s sodium-ion batteries annually at full capacity.

The company targets the ESS market.

Type of sodium-ion batteries: Prussian blue

Let’s not forget Unigrid in California. The US company raised $12 million in Series A funding and received MWh-scale purchase orders for 2024 delivery. They also received an investment from LG Technology Ventures.

Type of sodium-ion batteries: Tin alloy anode

In November 2024, The U.S. Department of Energy (DOE) awarded $50 million over the next five years to establish the Low-cost Earth-abundant Na-ion Storage (LENS) consortium. It will be led by DOE’s Argonne National Laboratory.

Europe

Faradion: Based in the UK, Faradion specializes in non-aqueous sodium-ion battery technology. The company was acquired by Reliance Industries for £100 million in 2022. They are now focused on the ESS market in India.

Type of sodium-ion batteries: Layered Oxides

Tiamat: Located in Amiens, France, Tiamat develops sodium-ion battery cells for power applications (power tool, ESS, MHEV). Tiamat is planning a factory for sodium-ion cells with an annual capacity of 5 GWh in France and received financial support from Stellantis.

Type of sodium-ion batteries: Polyanionic (NVPF).

Altris: Based in Sweden, Altris is developing cathodes with a potential capacity up to 2,000 tons/year in Sweden, equivalent to 3GWh of battery production.

Type of sodium-ion cathode: Prussian White

Sodium-ion vs Lithium-ion

Lithium-ion batteries are dominating the battery market by far. Sodium-ion batteries are at an early stage. The hype of 2022 has ceased a bit.

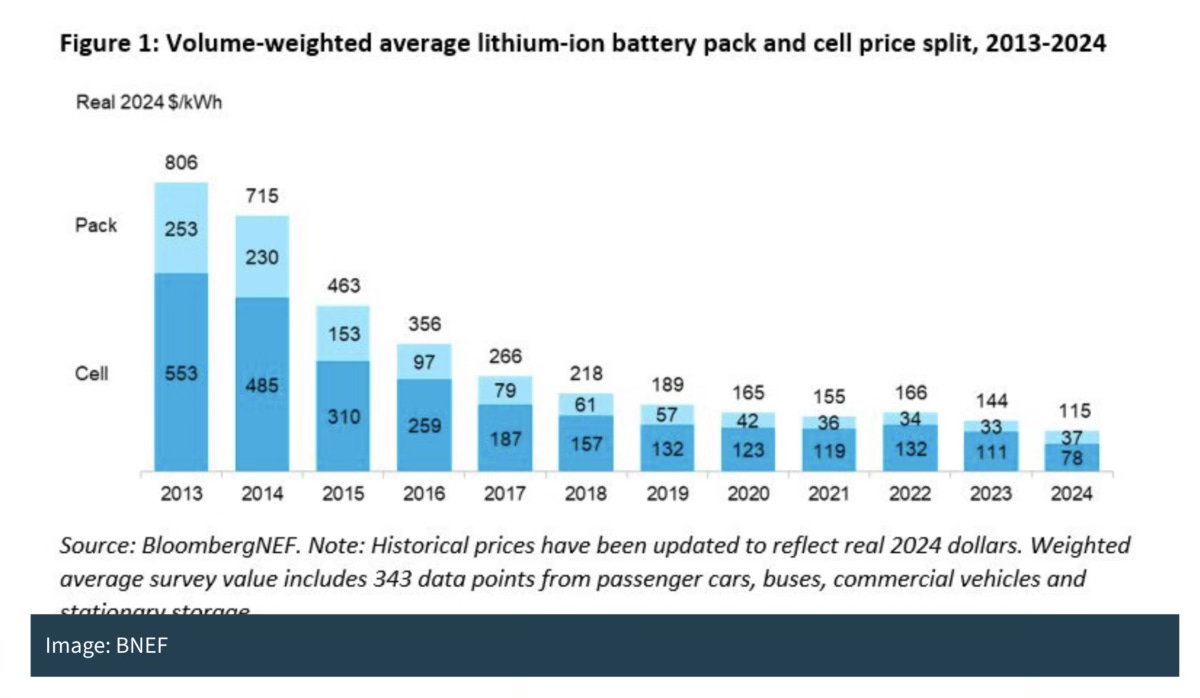

Lithium-ion batteries have a good balance between energy density and cycle life. The costs have decreased over time.

However, lithium-ion batteries are unstable and can cause fires and explosions in rare instances. Additionally, these batteries heavily rely on lithium, which has a highly volatile market price.

Sodium-ion batteries can serve as an alternative for very specific applications in the ESS market (e.g., UPS and data centers) and the EV market (micro and small EVs). These batteries are more stable. They can operate in extreme temperatures (-20°C to +60°C) and support full discharge to 0V.

They do not depend on scarce and expensive metals. This means that sodium-ion batteries could be cheaper once large-scale adoption is achieved (CATL).

Sodium-ion batteries might be a more sustainable option, as well.

Sodium-ion batteries face limitations for longer-range applications in the EV market. Their energy density is lower than that of lithium-ion batteries (160 Wh/kg compared to over 180- 200 Wh/kg). Sodium is heavier than lithium. For the EV market, weight is very sensitive.

Sodium-ion batteries are very dependent on lithium-ion battery prices. LFP batteries are currently very low at around 60€/kwh at the cell level.

Key Takeaways:

Sodium-ion batteries are emerging as a viable alternative to lithium-ion batteries, especially for energy storage and micro-mobility applications.

Renewed interest in sodium-ion technology surged in 2022 due to high lithium prices, leading to increased investment and development.

Abundant and cost-effective: sodium is over 1000 times more abundant than lithium, making sodium-ion batteries a potentially cheaper and more sustainable option.

Technology & limitations: sodium-ion batteries operate similarly to lithium-ion but have lower energy density (160 Wh/kg vs. 180-200+ Wh/kg), limiting their use in long-range EVs.

Market Status: still in early commercialization (as of 2025), with small-scale production. China leads the market, projected to hold 90% of global capacity by 2030.

Key Players: major contributors include CATL, BYD, Hina (China), Natron (USA), and Tiamat (France).

Future Outlook: sodium-ion batteries are expected to capture a niche in energy storage (ESS) and entry-level EVs, with forecasts ranging from 40 GWh to 335 GWh production capacity by 2030.

Competition with lithium-ion: while sodium-ion batteries are safer, cheaper, and more sustainable, they are heavily dependent on lithium-ion price trends and are not yet a direct replacement for all applications.

Now, let’s look at this week's battery market developments.

Battery Industry Pulse: Weekly Roundup

Raw Materials

Components

Umicore held its Capital Markets Day, this week. - key takeaways.

Battery

Volvo Cars bets on sodium-ion batteries by investing in Swedish startup Altris

LG Chairman Koo Kwang-mo Emphasizes Batteries as a Key Business for LG Group

Battery Recycling

BESS

TotalEnergies invests $172.8m in six German battery storage projects

LG Energy Solution Secures Grid-scale ESS Supply Agreement in Europe with Poland’s PGE

Passengers EVs

President Donald J. Trump Adjusts Imports of Automobiles and Automobile Parts into the United States

Hyundai Motor Group Commits to U.S. Growth with USD 21 Billion Investment

Other EVs

Charging infrastructure

Don’t hesitate to leave a comment or reply to this email to share your feedback. My goal is to make the best newsletter for you.

As you say, "The sodium-ion batteries have a weakness. The low energy density (max 160-165 Wh/kg) limits its broader EV potential."

Battery electric vehicles (BEVs) are already greatly disadvantaged with low energy density compared to gas and diesel. Sodium-ion instead of lithium,-ion would be even worse - not a chance they would ever be commercially viable.

I'm getting 2 different figures; don't know which is correct, but obviously either number makes my point:

"Stored energy in fuel is considerable: gasoline is the champion at 47.5 MJ/kg and 34.6 MJ/liter; the gasoline in a fully fueled car has the same energy content as a thousand sticks of dynamite. A lithium-ion battery pack has about 0.3 MJ/kg and about 0.4 MJ/liter (Chevy VOLT)"

That's an incredible 158 times as much energy density in gasoline.

"gasoline exhibits an energy density of 12,700 Wh/kg, which is approximately 63 times greater than that of a Li-ion battery".

So gas is somewhere between 63 and 158 as energy dense! No wonder an EV battery has to be about half the weight and half the cost of an EV! And even at that, range is still a primary concern.