Summary

China’s export controls on battery-related items

Battery Industry Pulse: weekly roundup.

Welcome back to another edition of my newsletter! - Week 41 2025

On October 9th, China announced export controls on items related to lithium batteries, cathode materials, and graphite anode materials.

The measure will take effect on November 8, 2025.

Scope of the new export measures

The new rules cover:

• Lithium-ion batteries with energy density ≥300 Wh/kg

• Manufacturing equipment for lithium-ion batteries

• LFP cathode materials with ≥2.5 g/cm³ density and ≥156 mAh/g capacity

• Ternary precursors (NCA, NCM)

• Cathode-material manufacturing equipment

• Artificial graphite anode materials and blended graphite mixes

• Manufacturing equipment, technology, and processes for graphite anodes

You can find all the listed items in this document.

China doubles down on battery supply chain controls

It’s not the first time China has imposed export controls on battery-related items.

In 2023, China implemented export controls on natural graphite, requiring special export permits for certain grades.

Last July, it added battery cathode material preparation technology to the restricted export list. The move affects lithium iron phosphate (LFP) and LMFP. This concerns the latest fourth-generation LFP cathode technology.

Now, the number of controlled items is far larger than in previous measures.

Strategic choke points: where China holds the edge

Targeting LFP cathodes, synthetic graphite anodes, and manufacturing equipment is deliberate.

China produces about 99% of LFP cathode material.

It holds roughly 97% of the synthetic graphite anode market (BMI, 2023).

China dominates the supply chains and wants to keep the technological edge. It means China is open to do business with the rest of the world, but not with the latest technology.

Why China targets high‑energy‑density batteries

China’s EV and ESS markets rely on LFP, a lower energy density chemistry. Still, China wants control of high energy density cells at or above 300 Wh/kg.

For now, these cells go mainly into drones, defense, and eVTOL.

These uses are niche. They serve as proving grounds for next-gen designs like silicon anodes and lithium metal.

I believe China is targeting semi-solid and solid-state batteries in particular. Over the past two years, Chinese firms have led on semi-solid, with products already in the field.

Solid state battery is next. Chinese OEMs and battery makers keep announcing pilot lines and near-term production.

Battery manufacturing equipment: the hidden dependency

Europe and North America want to make more cells and materials at home. They still depend on Chinese equipment.

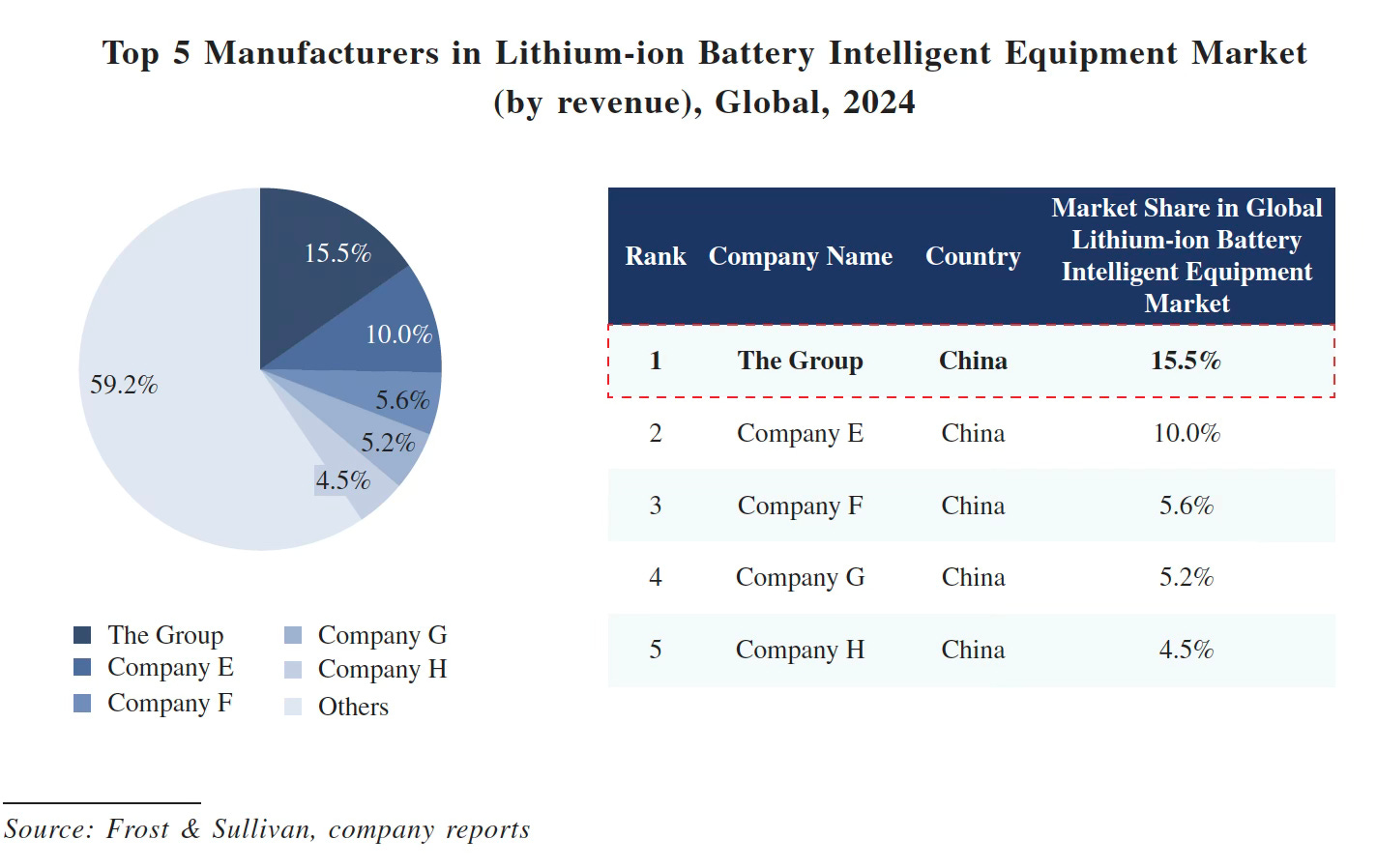

Wuxi Lead Intelligent Equipment, based in China, is the global leader in battery manufacturing tools.

Its IPO filing lists customers such as CATL, Tesla, Volkswagen, BMW, Mercedes, Toyota, LG Energy Solution, SK On, Samsung SDI, Panasonic, ATL, CALB, EVE Energy, Gotion, AESC, Ampace, Sunwoda, SVOLT, BYD, and ACC.

These are the major producers from Korea, China, and Japan. They cover the entire top ten of the EV battery market.

New entrants like Tesla and ACC are also on the list. Wuxi Lead also supplies PowerCo’s Salzgitter plant. They were the main manufacturing equipment supplier to Northvolt.

The remaining four of the top five battery equipment makers are Chinese.

Their machines run gigafactories worldwide. Making batteries without them is difficult.

What the new export rules really mean

Exporters of the listed items must now obtain licenses.

That adds paperwork and can slow shipments.

We saw the same pattern with natural graphite. Companies shipped early to build inventory, then volumes fell in the first months of restrictions. Flows returned to normal after some months as exporters learned the new process.

I believe this will not change the industry’s core dynamics. It is less about disrupting trade and more about leverage.

It opens another front in the economic contest between China and the United States. President Trump has already announced a 100% tariff on Chinese products.

Europe is again in the middle. This is the time to think long-term and act with intent.

Europe should open a serious discussion on an industrial plan to be competitive. It should anticipate rather than manage crises.

PS: If you want an overview of CATL, I build a company profile just for you. It’s covering strategy, governance, revenue drivers, global footprint, EV and ESS products, and more. Clear, factual, and built to save you hours.

Use the code CATL99 to get it for 99 €, a 38% discount.

Now, let’s look at this week's battery market developments.

Battery Industry Pulse: Weekly Roundup

Metals

Components

Battery

Maersk and CATL forge strategic partnership to accelerate low-carbon supply chain transformation

What Lyten plans to do in Heide after the Northvolt takeover

Renault subsidiary Ampere opens innovation laboratory for battery cells

Battery recycling

Passengers Cars

CATL’s Intelligent Vehicle Unit Raises Nearly RMB 2 Billion in First External Funding Round

Ferrari unveils chassis and technology for its first electric car

German government coalition agrees on EV subsidies for low and middle incomes

Dacia introduces enhanced Spring with LFP battery and a Kei Car concept

🤝 For newsletter sponsorships - Click here

🤳 You can also follow me on LinkedIn - Click here