China's export controls on LFP shake up the global battery market; Tesla's success story in energy storage systems continues.

Every week, the battery landscape shifts in fascinating ways — this one is no different.

Excited to welcome you to my new newsletter!

Together, we’ll embark on a journey to explore the fascinating world of batteries.

I hope you discover valuable insights along the way!

Summary

Special topic: China wants to restrict the export of LFP (Lithium Iron Phosphate)/LMFP (Lithium Manganese Iron Phosphate) technology

Highlight of the week: Tesla ESS (energy storage systems) deployments in 2024

Battery Industry Pulse: Weekly Roundup

Special Topic: China wants to restrict the export of LFP/LMFP technology

On January 2, 2025, China's commerce ministry has proposed export restrictions on:

LFP technology

LMFP technology

Phosphate-based cathode precursor

Lithium processing technology

What does this mean for the rest of the world?

China accounts for over 60% of global lithium refining for batteries (S&P data). However, lithium processing is less critical. Western companies, like Albemarle and SQM, also hold significant expertise in lithium hydroxide and carbonate technologies, keeping them competitive in the lithium market.

The first three technologies are critical—and China controls the supply chain.

Now, let’s focus on LFP technology.

LFP chemistry represents 70% market share in China for the EV market (CABIA data). The main advantage of this technology is the cost. No nickel and no cobalt make it affordable.

LFP technology is getting a lot of traction outside China. For now, the LFP market share is limited to around 10% of the EV market. But, western OEMs are struggling with EV growth in Europe. EVs are too expensive for consumers.

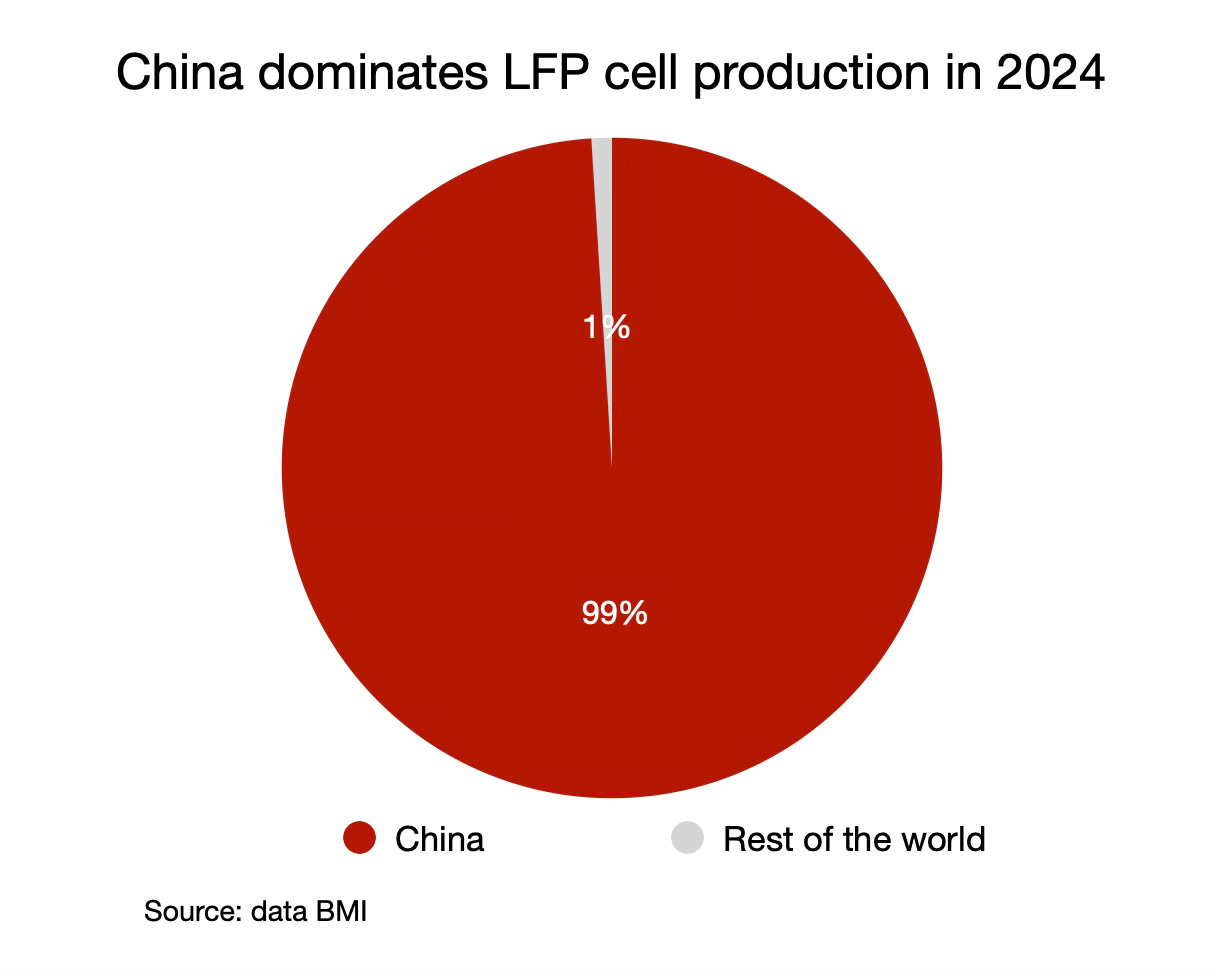

One of the solutions is LFP. The Western are hesitating to add LFP chemistry to their roadmap. I can understand why. China produces almost 100% of LFP battery cells and cathodes.

With these potential restrictions, some projects are in danger. Recently, Stellantis confirmed its JV with CATL in Spain to produce LFP cells. It’s a $4 billion investment. Now, this project could be jeopardized.

The same is true for cathode and battery projects in Morocco (Gotion, CNGR).

There’s also a strong uncertainty in the ESS market in the US.

LFP largely dominates the ESS global market. LFP’s long life cycle makes it the most suitable chemistry for the ESS market. The combination of the US tariffs on Chinese cells and China's potential LFP technology export restrictions could slow ESS growth in the US.

You can find more information about China's proposal on export restrictions in the document (in Chinese) below or the quick summary with the specifics in English (here)

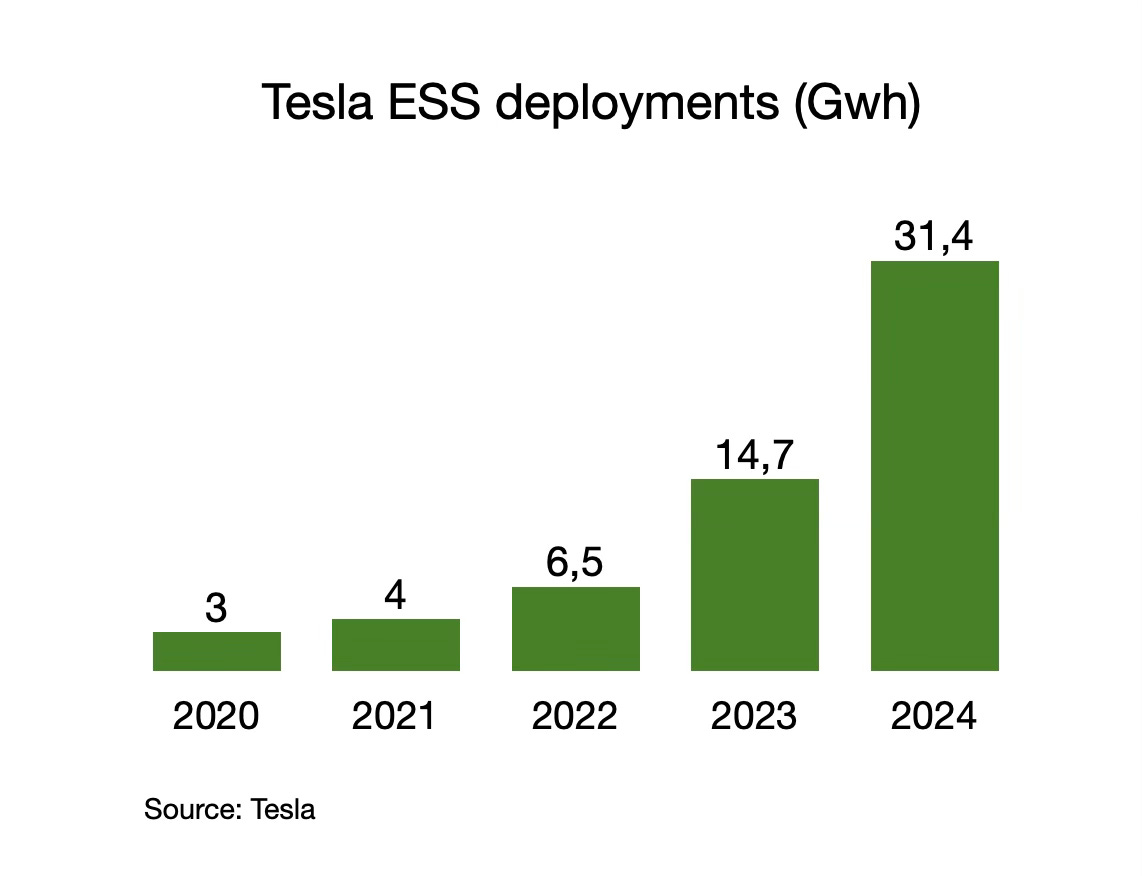

Highlight of the week: Tesla ESS deployments in 2024

This week, most people on LinkedIn were talking about Tesla EVs deliveries for 2024.

But, they forgot to mention the ESS deployments. The story is different.

This market is booming since a few years. Tesla is the perfect example with incredible growth (+114% YoY) in 2024. The American company deployed 31.4 GWh of energy storage products, last year.

It will continue. Tesla just started trial production at its new Shanghai Megafactory. They completed the construction in just 7 Months. The plant is expected to have 40 GWh production capacity annually.

Tesla already have a Megafactory in Lathrop, California capable of producing 10,000 Megapack units every year (equal to 40 GWh).

Tesla is ready to meet the strong demand and become a leader in the ESS market.

Now, let’s have a look at this week's battery market developments.

Battery Industry Pulse: Weekly Roundup

Metals

KoBold Metals raises $537M for critical minerals new exploration - link

Battery

A Tesla Cybertruck burned down at Tesla lot in Atlanta, battery fire suspected - link

South Africa could get Tesla battery plant in exchange for Starlink deal - link

SAIC-GM-Wuling starts EV battery pack production in Indonesia - link

AESC signs agreement for battery factory's phase II in Cangzhou, Hebei Province - link

Battery Equipments

Stellantis successfully completes Comau transaction, a global technology company specializing in industrial automation and advanced robotics. - link

BESS

Tesla Shanghai Megafactory begins trial production, seven months after construction started - link

Passenger EVs

BYD has successfully achieved its annual target of 4 million units in 2024 - link

NIO delivered 221,970 vehicles in 2024, reflecting an increase of 38.7% YoY. - link

Five models from Hyundai Motor Group are now included in the 25 EV models qualifying for US tax credits in 2025 - link - full list

China NEV wholesale at record 1.5 million in December - link

Tesla delivered 1.78 million EVs in 2024 - link

Geely Auto sets ambitious 2025 sales target of 1.5 million NEVs, +69% YoY growth - link

Charging infrastructure

Nio reaches 3,000 swap stations in China - link

Don’t hesitate to leave a comment or reply to this email to share your feedback. My goal is to make the best newsletter for you.

Thanks Christopher!