Global BEV Sales Surge in Q1 2025 But Tesla Falls Behind.

Every week, the battery landscape shifts in fascinating ways — this one is no different.

Welcome back to another edition of my newsletter! - Week 15 2025

This week, I’ll discuss the performance of BEVs in major markets, along with key Q1 2025 results from several OEMs.

Summary

The highlight of the week: BEV sales by region and by OEM

Battery Industry Pulse: Weekly Roundup.

The highlight of the week: BEV sales by region and by OEM

The EV market represents the largest source of demand for the battery industry, accounting for more than 70% of lithium-ion battery demand.

This market is strategic for battery cell manufacturers.

In Q1 2025, the battery electric vehicle (BEV) market continues to grow despite headwinds.

The U.S.

In the U.S., nearly 300,000 BEVs were sold in Q1 2025, an 11% increase compared to last year (Source: Kelley Blue Book).

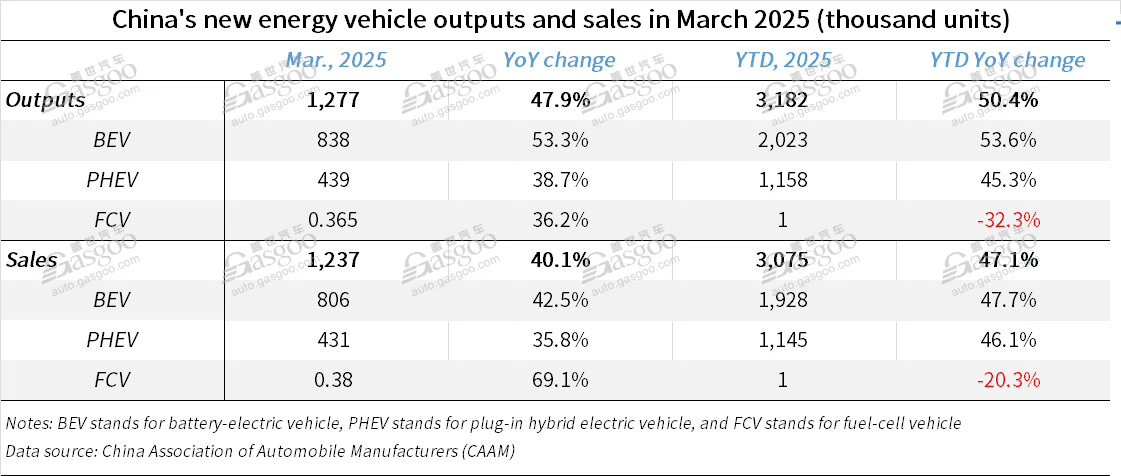

China

China is currently the world’s largest EV market. Europe and the U.S. are still far behind in terms of electrification.

China’s wholesale of BEVs reached over 1.9 million units in Q1 2025 (including exports), up 48% year-over-year (YoY). Retail sales of BEVs in China reached 1.5 million units in Q1 2025, up to 46% (Source: CPCA).

Europe (preliminary results)

The UK: The BEV market grew by 43% year-over-year, with 120,000 units sold. The UK remains the largest BEV market in Europe.

The Netherlands: A total of 32,439 BEVs were registered in Q1, marking a 7.9% year-over-year increase. This brings the EV market share to 35.3%, demonstrating that electrification remains on a steady upward trajectory.

Sweden: Nearly 21,000 BEVs were sold in Q1, up 13% compared to last year. The BEV segment now holds a 33% market share, making it the leading segment in the country.

Germany: The BEV market increased by 39% in Q1 2025, with 113,000 units registered.

Italy: In the first three months of the year, BEV registrations rose by 72.5%.

Spain: In Q1 2025, BEV deliveries surged by 68.8%, reaching 19,225 units.

While not all results are available yet, the initial figures show that European markets are performing strongly in the BEV segment compared to last year.

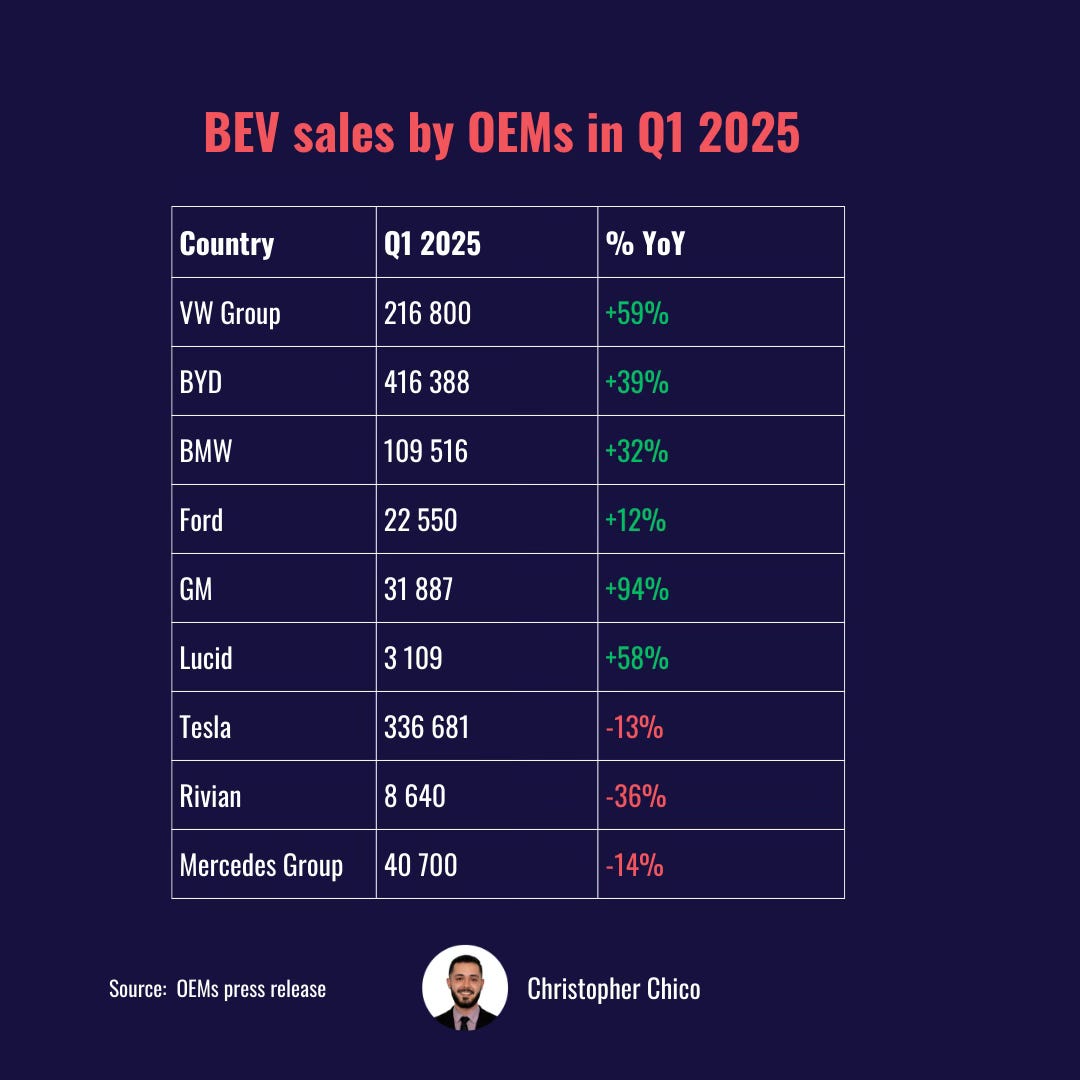

BEV sales by OEM (list non-exhaustive)

The winners of Q1 2025 are VW Group (+39% YoY), BYD (+39%), and BMW (+32%). All three recorded strong BEV sales volumes during the first quarter.

VW Group’s global EV market share increased from 6% to 10%. In Europe, Volkswagen delivered over 150,000 EVs in the first three months of 2025, more than doubling sales (+113%). Volkswagen is now the BEV market leader in Europe, holding around 26% of the market. Six of the ten best-selling models in Europe are Volkswagen vehicles. The company has used rebates effectively to boost EV sales across European markets.

In China, however, competition remains fierce. VW Group’s sales declined by 37% in Q1 2025.

BYD is now the global BEV leader in Q1 2025, with over 416,000 units sold (+39% YoY), surpassing Tesla. The Chinese automaker led the NEV market in China with a 30% market share, leaving competitors far behind. BYD’s strength lies in its wide portfolio, offering models from budget-friendly to premium.

BMW Group delivered around 109,000 all-electric cars in Q1, marking a 32% increase. In Europe, electric vehicle sales grew by 64%. The Mini brand performed particularly well, with one in three vehicles delivered being fully electric. BMW also benefited from a fully revamped product lineup introduced last year.

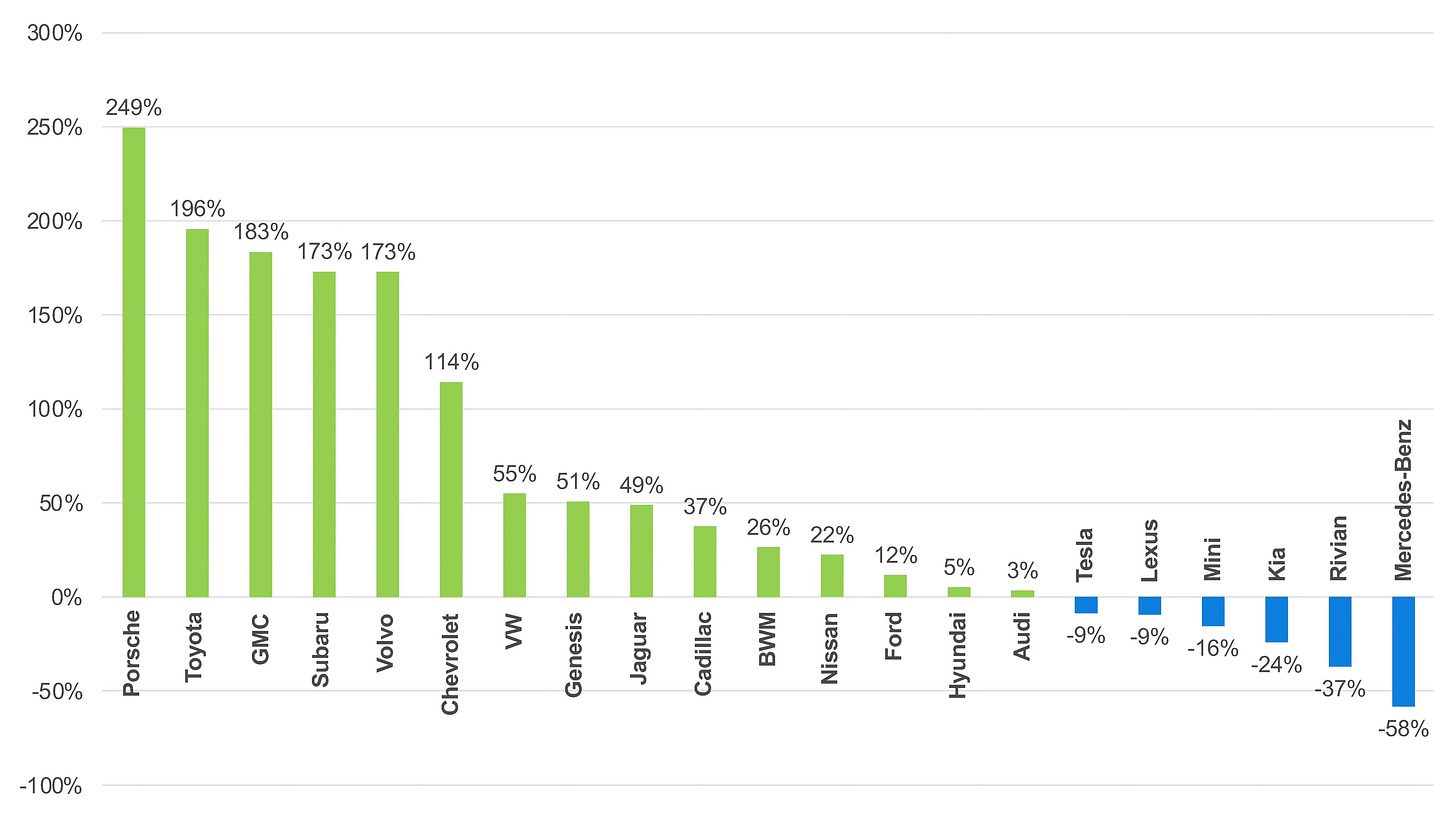

Tesla faced challenges, with a 13% YoY decline in Q1 2025. In the U.S., sales dropped by 9%. In China, Tesla recorded 134,607 retail sales in Q1, a modest 2% increase YoY. However, the company struggled significantly in Europe, with sales down more than 50% in four countries: Germany, the Netherlands, Sweden, and Denmark.

This decline is largely due to the changeover of Model Y production lines across all four of Tesla’s factories, which led to several weeks of lost production in Q1. Additionally, competition has intensified in both Europe and the U.S. I also believe part of Tesla’s weaker performance in Europe can be attributed to backlash against Elon Musk, particularly in response to his recent political involvement.

Rivian delivered only 8,640 BEV units in Q1 2025, a 36% drop YoY while producing 14,611 units during the same period. In a February earnings call, Rivian cited seasonality and a challenging demand environment as key factors weighing on sales. The company also noted that the L.A. wildfires contributed to the decline. Like Tesla, Southern California is a particularly important market for Rivian.

Mercedes-Benz sold just 40,700 BEV units in Q1 2025, a 14% decrease year-over-year. The German brand explained that "overall sales were influenced by model transition dynamics in the Entry segment, especially in Germany after the electric Smart was phased out in Europe." Mercedes-Benz remains significantly behind its direct competitor, BMW.

Now, let’s look at this week's battery market developments.

Battery Industry Pulse: Weekly Roundup

Raw Materials

Components

Battery

CATL approved for at least $5 billion Hong Kong listing, sources say

LG Energy Solution Makes Notable Progress in Construction and Hiring in Arizona

Battery Equipment

Passengers EVs

Charging infrastructure

Don’t hesitate to leave a comment or reply to this email to share your feedback. My goal is to make the best newsletter for you.