Inside the collapse of Western battery startups – key mistakes revealed

Every week, the battery landscape shifts in fascinating ways — this one is no different.

Welcome back to another edition of my newsletter! - Week 6 2025

In this new edition, we examine the common mistakes that Western start-ups make in the battery industry. This week, two battery cell projects in the U.S. have been canceled, and this trend is likely to continue.

Summary

Special topic: Western battery startups: why they struggle and what went wrong

Battery Industry Pulse: Weekly Roundup.

Special topic: Western battery startups: why they struggle and what went wrong

In recent months, several Western companies have faced significant challenges in the battery industry, particularly with battery cell manufacturing. Notably, KORE Power and Freyr Battery have both canceled their respective U.S. battery cell projects.

It appears that many Western companies have underestimated the complexities of cell manufacturing, mastering it is no easy task.

In the following sections, we will analyze various business cases. But first, let’s take a closer look at cell manufacturing.

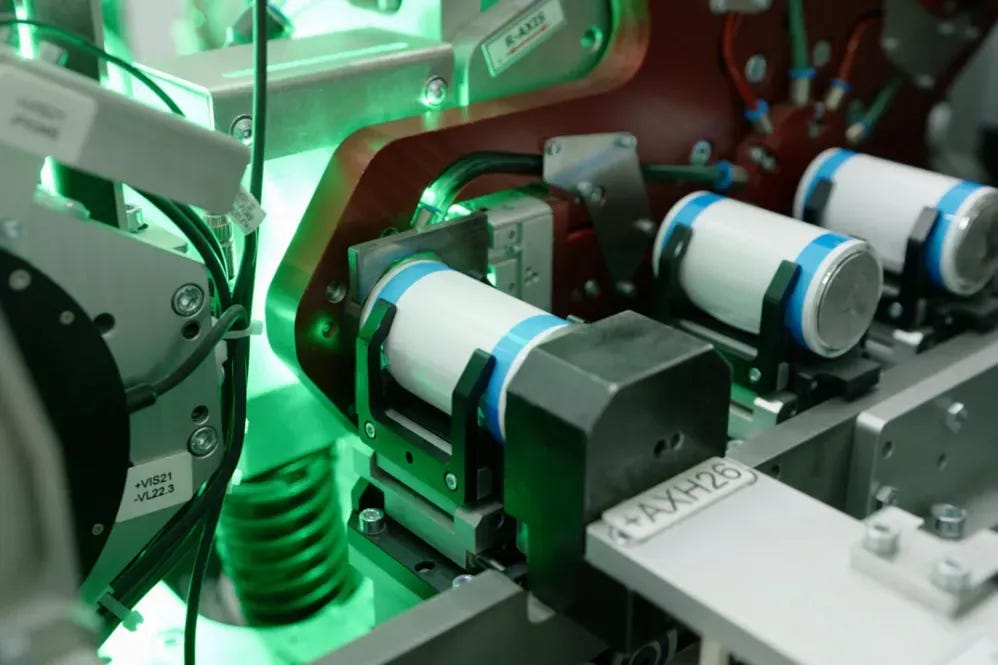

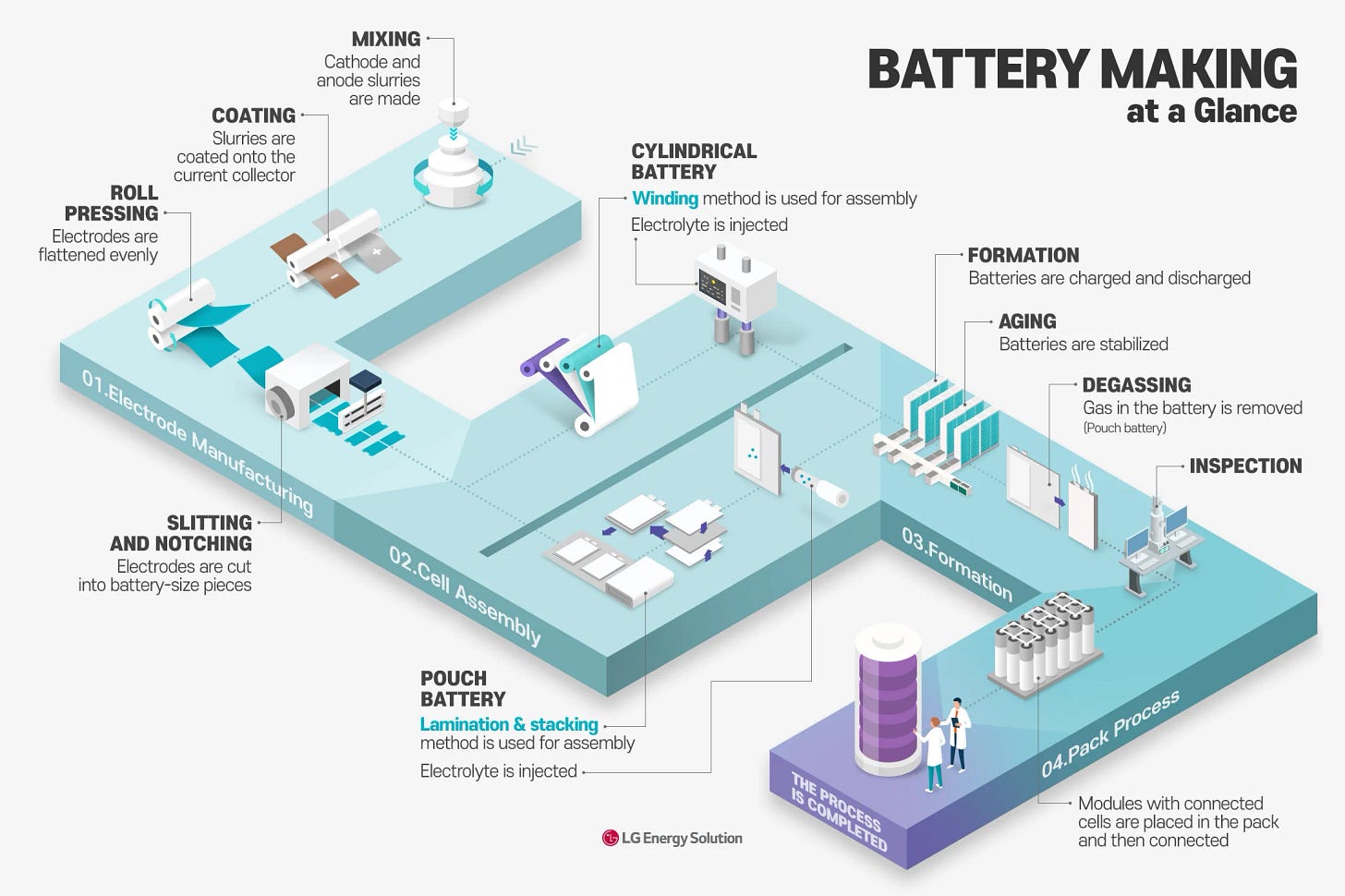

Cell manufacturing process

Battery cell manufacturing is a highly precise, multi-stage process that transforms raw materials into functional energy storage units.

The industrial production of lithium-ion batteries usually involves 50+ individual processes, which can be divided into three stages: electrode manufacturing, cell fabrication, formation, and integration.

A typical battery cell manufacturing flowchart includes:

Electrode Production: Mixing → Coating → Drying → Calendering → Slitting.

Cell Assembly: Stacking/Winding → Electrolyte Injection → Sealing.

Formation: Aging → Charging → Degassing.

Testing & Sorting.

Battery cell manufacturing is a delicate balance of precision engineering, material science, quality, and scalability.

Now, let’s take a closer look at some business cases of Western companies struggling in the battery industry.

Battery start-up business cases

Northvolt is arguably the most famous case in the West for its struggle to master cell manufacturing, despite once being the most promising European company. Founded in 2017 with the ambition of building the world’s greenest battery, Northvolt has raised around $13–14 billion, attracting investments from VW, Goldman Sachs, and BMW.

For over two years, the company has been struggling to ramp up production at its Swedish battery cell plant. To be economically viable, the plant needs to achieve more than a 90% production yield, yet it remains in what many describe as “Death Valley.” In addition to cell production, Northvolt has been involved in various activities, including a lithium project in Portugal, as well as initiatives in cathode active materials, anode active materials, and battery recycling.

Northvolt was undeniably ambitious, perhaps too ambitious. The company burned through all its cash and even filed for bankruptcy protection in the USA under Chapter 11. It is now searching for 2 billion euros in funding over the next two years to keep its Swedish battery cell plant operational.

Kore Power is a U.S.-based company that designs and develops energy storage solutions, specifically, battery-based energy storage systems (ESS). The company’s goal was to produce its own battery cells for a more integrated approach, planning a $1 billion investment in Arizona. In 2023, Kore Power secured an $850 million loan from the U.S. DOE, which was intended to cover about 80% of the facility's cost.

Kore Power purchased land in 2022 and was scheduled to start construction that same year, but construction never began. The company cited restructuring and a focus on long-term success as reasons for abandoning the project. Founded in 2018, Kore Power is a young company, and the project ultimately proved too large in scope.

While they intended to produce both LFP and NMC batteries, there is a significant difference between manufacturing battery cells and full energy storage systems. Although LFP chemistry is the most suitable for the ESS market, producing LFP batteries would mean competing with Chinese cell suppliers, who are currently supplying Kore Power.

Freyr Battery is a Norwegian company founded in 2018. Its original plan was to produce LFP pouch cells using semi-solid battery technology from 24M. The company began by building and completing a customer qualification plant in Norway. The next step was to develop a giga-scale battery cell plant in Norway, called Giga Arctic. They then announced another battery cell project in the U.S. to take advantage of the IRA. Although they started construction on Giga Arctic, they eventually halted it because Giga America offered more attractive incentives in terms of grants, tax credits, and other advantages. Unfortunately, this week they announced the cancellation of the Giga America project.

In addition to their battery cell projects, Freyr is involved in a joint-venture project for LFP cathode active materials, which will receive a grant of 122 million euros from the European Union Innovation Fund. They also recently acquired Trina Solar’s 5 GW module factory in Texas.

Morrow is a Norwegian company founded in 2020. Last year, it opened its first battery cell factory in Arendal, Southern Norway, with an annual capacity of about 1 GWh. Three weeks ago, Morrow Batteries announced strategic measures to secure the start-up of commercial LFP battery production. Consequently, other projects will be postponed to focus on core activities that drive immediate value creation. These changes will result in a workforce reduction of 50 to 60 positions, leaving the company with approximately 180 employees. It’s unclear what the other projects were, but I know they were heavily focused on a new lithium-ion battery chemistry, LMNO, alongside LFP and NMC. LMNO is slated to be their future chemistry.

Li-Cycle is a Canadian battery recycler whose ambition was to build pre-treatment and hydrometallurgical processing facilities for batteries. They announced several Spokes (pre-treatment units) that are far less expensive. In the end, they built three Spokes in Alabama, Arizona, and Germany, while pausing those in France and Norway, which is not inherently problematic. However, they underestimated the CAPEX of their hydrometallurgical processing plant in Rochester, U.S. They were close to finishing construction of the hydro plant when they “discovered” that their budget was way off.

A few years ago, I conducted a market study on battery recycling processing and was surprised by Li-Cycle’s lower CAPEX estimates compared to other players and prevailing economics. As a result, they halted construction due to a lack of cash. Recently, they secured a DOE loan of $475 million but are still seeking additional financing. They have had to adjust their strategy slightly: instead of producing nickel and cobalt sulphate, they will now focus on MHP (mixed hydroxide precipitate).

Now, let’s see the common mistakes these companies made:

Lack of focus: As newcomers to the battery industry, they took on multiple projects and aimed for vertical integration, inspired by Chinese and Korean companies with 25 years of experience. However, those established players didn’t rush the process, it took them years to achieve full integration.

In contrast, Western companies like Northvolt and Freyr lost focus on their core business: battery cell manufacturing. They burned through cash and underestimated just how capital-intensive (CAPEX) and operationally demanding (OPEX) large-scale cell production really is.

Total Energies CEO Patrick Pouyanné, one of ACC’s owners, recently said:

“From my point of view as an industry representative, it is better to concentrate efforts on one plant than three”. It’s a reference to ACC paused its two plants in Italy and Germany.

By doing everything, you are doing nothing.

Lack of experienced talents: Let’s be honest, Asian companies are the only ones that can produce battery cells at giga scale. They have been doing it for a long time. In the West, we have talented people, especially in research, but with few exceptions, we lack experience in large-scale cell manufacturing. Mastering cell production is a skill, requiring countless steps before a fully formed battery cell is ready.

To bridge this gap, Western companies must attract skilled Asian workers. Northvolt managed to do this but struggled with communication issues with its workforce and equipment supplier. Even a well-established Asian battery producer faced high scrap rates when it first began production in Europe and had to bring in skilled workers from Asia to train its European employees.

CATL, on the other hand, found a way to avoid these challenges. It ensures that about half of the workforce at a new plant comes from an existing facility, allowing knowledge transfer and smoother operations.

Unproven technologies: Freyr rushed into unproven semi-solid batteries (via 24M technology) without real-world experience. Morrow bet on experimental LMNO chemistry.

Both companies ultimately switched back to standard lithium-ion batteries. The lesson? Flashy future tech grabs attention, but today’s winners master what already works.

Underestimated Capex and Opex: Rookie battery makers are learning the hard way that inexperience comes at a price. Many newcomers drastically underestimate both upfront investments (Capex) and operating costs (Opex). Fraunhofer FFB and RWTH Aachen University calculate that every day of delayed production startup drains €1.1 million in lost profits for a typical battery cell plant. But the bleeding doesn’t stop there. Even seemingly small inefficiencies compound fast. Every percentage point increase in scrap rates burns through an extra €30,000 daily. Do the math: that’s €10 million vanishing annually from a 1% scrap rate alone.. They can quickly being money dry. That’s what happened to Northvolt.

Forgot about competition: the Western companies may have forgotten that they have to compete with the Asian battery cell producers (CATL, LGES, Panasonic, Samsung SDI). Ultimately, customers prioritize cost over origin when quality is comparable. For example, Tesla decided to produce its own cells and use dry coating technology. Tesla competes with its own suppliers, especially Panasonic. Elon Musk put an ultimatum on Tesla’s team to be cost competitive with Panasonic cells. When a Western company decides to manufacture LFP cells, it faces an uphill battle against Chinese suppliers, who dominate the market. The truth is, competing on price is extremely difficult, if not nearly impossible, given how critical battery costs are for automotive OEMs.

Now, let’s look at this week's battery market developments.

Battery Industry Pulse: Weekly Roundup

Metals

Stardust Power inks long-term lithium supply deal with Sumitomo - link

Global Li-Ion enters exclusive MOU to purchase 100% in the Montepuez Graphite Project - link

CATL is resuming production at its Jiangxi lithium mine - link

Components

ElevenEs enters into a JDA with CarbonX to validate a new type of anode material - link

SK Nexilis develops current collectors for all-solid-state batteries - link

Battery

France secures €48m EU investment for AESC battery plant - link

KORE Power kills $1 billion Arizona EV battery factory plans - link

Mullen buys Nikola’s battery business - link

LG Energy Solution will supply 2170 batteries for Tesla’s latest car model Model Y Juniper - link

Toyota Battery Manufacturing North Carolina is ready to begin production - link

Volvo Cars says it will pay Northvolt almost nothing for battery joint venture stake - link

Freyr Battery cancels $2.6 billion Georgia battery factory plans - link

Battery recycling

Li Cycle finds recycling partner in Germany - link

Altilium announced the commencement of its recycling operations for LFP batteries in the UK - link

BESS

Tesla Megapacks chosen for 548 MWh energy storage project in Japan - link

Tesla is set to start production at its Shanghai Megafactory on February 11 - link

Passenger EVs

Honda aims to launch $1B+ ‘next-gen’ car factory in Ohio - link

Ferrari plans to launch first fully electric car in Italy in October - link

Toyota Motor plans to set up BEV & battery R&D, production company in Shanghai - link

Ford posts another big loss for its EV division in 2024 - link

Commercial EVs

Solaris will deliver 50 electric buses to MZA Warsaw - link

Marine

Corvus Energy will deliver a mega-size battery system for the first fully electric offshore vessel - link

Don’t hesitate to leave a comment or reply to this email to share your feedback. My goal is to make the best newsletter for you.

Interesting summary; thanks from a new reader

Lack of focus on one item at a time is a major cause for the failure of Western companies. China and Korea took years to master the process. Western companies can not do it over a night. Cell recycling is an area where Western companies should focus tpo have a lead as that area is still at nascent stage IMO. Then with mastering of the recycling process, Western companies can have a good lead over Asian companies.