LG Energy Solution: China's most dangerous battery competitor

Every week, the battery landscape shifts in fascinating ways — this one is no different.

Welcome back to another edition of my newsletter! - Week 9 2025

The Chinese firms dominate battery talks. However, the Korean players remain strong. LG Energy Solution combines technological innovation with a global presence. This analysis explores LGES's strategy and market position.

Summary

Special topic: LG Energy Solution: The Korean Champion

Battery Industry Pulse: Weekly Roundup.

Special topic: LG Energy Solution: The Korean Champion

LG Energy Solution (LGES) was originally part of LG Chem, a subsidiary of the South Korean LG Corporation. LG Chem began its battery business in 1992 and entered the lithium-ion battery market in 1999. In 2009, LG Chem pivoted to automotive batteries, supplying the Chevrolet Volt.

In December 2020, LG Chem spun off its battery division into LGES to focus on advancing EV and energy storage system (ESS) innovations. LGES went public in January 2022, raising $10.7 billion in South Korea’s largest IPO.

LGES serves major automakers, including Volkswagen, Tesla, Ford, General Motors, Stellantis, Renault, and BMW. It holds an 11% market share in the EV battery sector, ranking third globally behind CATL and BYD.

LG Energy Solution products and markets

LGES makes pouch and cylindrical cells. It is developing 46-series cylindrical cells for U.S. production by year-end. While LGES can produce prismatic cells, it is not a focus. Pouch cells are central to its strategy.

LG Energy Solution’s CTP solution-applied pouch-type batteries have about five percent higher energy density per weight compared to the prismatic CTP technology batteries, offering higher energy efficiency for EVs.

As a major battery maker, LGES serves the EV (passenger and commercial vehicles), ESS, and consumer electronics markets.

LG Energy Solution chemistry roadmap

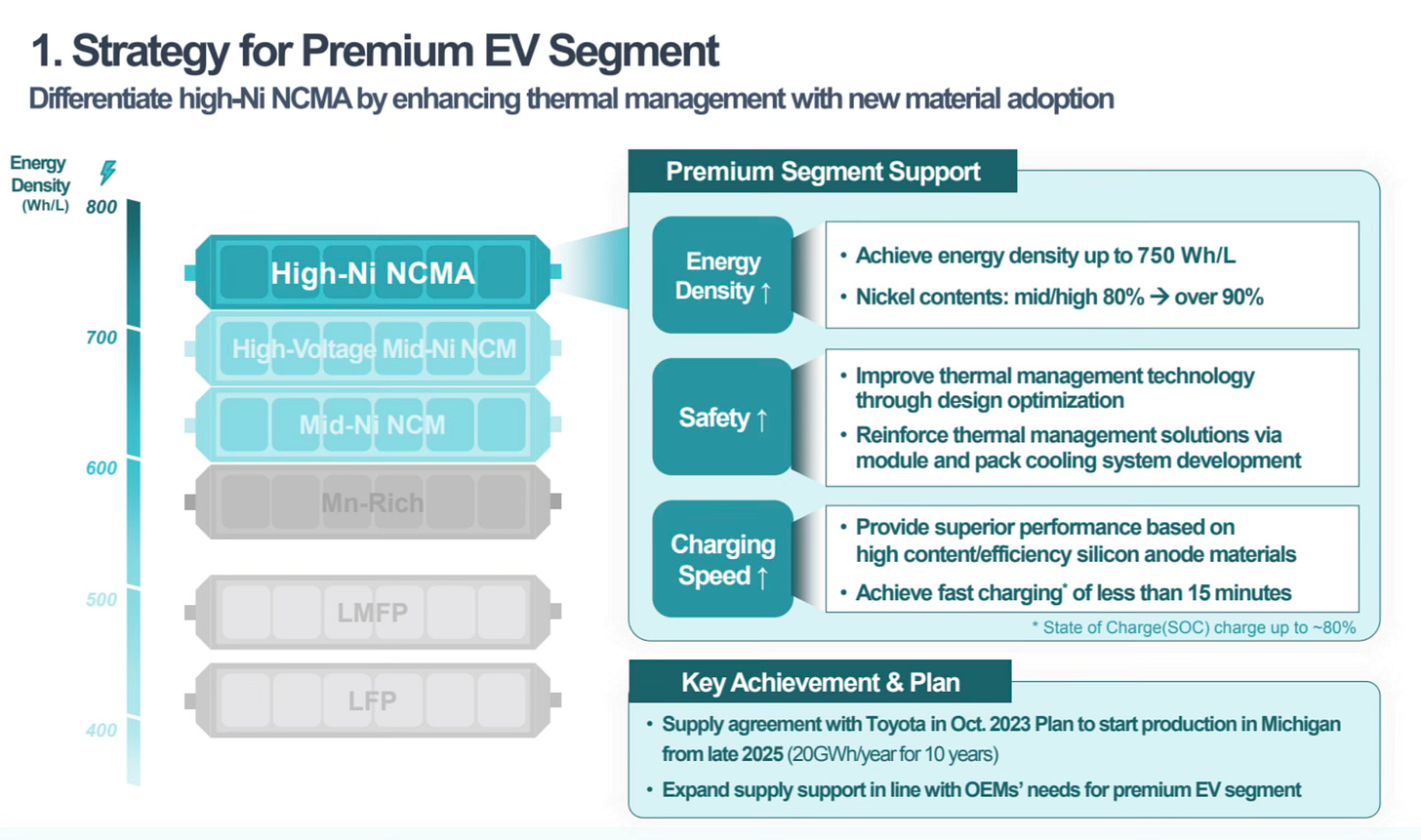

NCMA

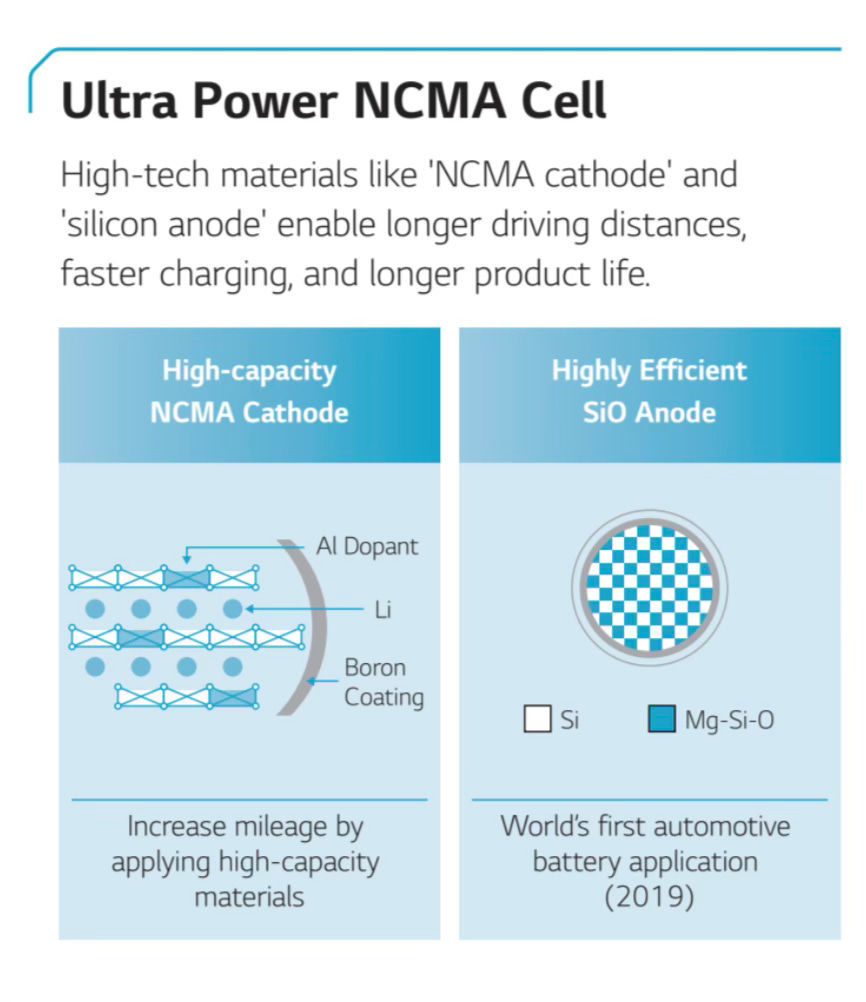

LGES has long focused on NCM technology. For several years, the Korean company has developed its proprietary chemistry, NCMA, which incorporates aluminum mainly to stabilize the structure and boost overall performance and safety.

LG Energy Solution reserves this chemistry for the premium EV segment due to its high energy density. It is for long range and charging speed (thanks to the silicon anode).

High Voltage Mid-Nickel NCM

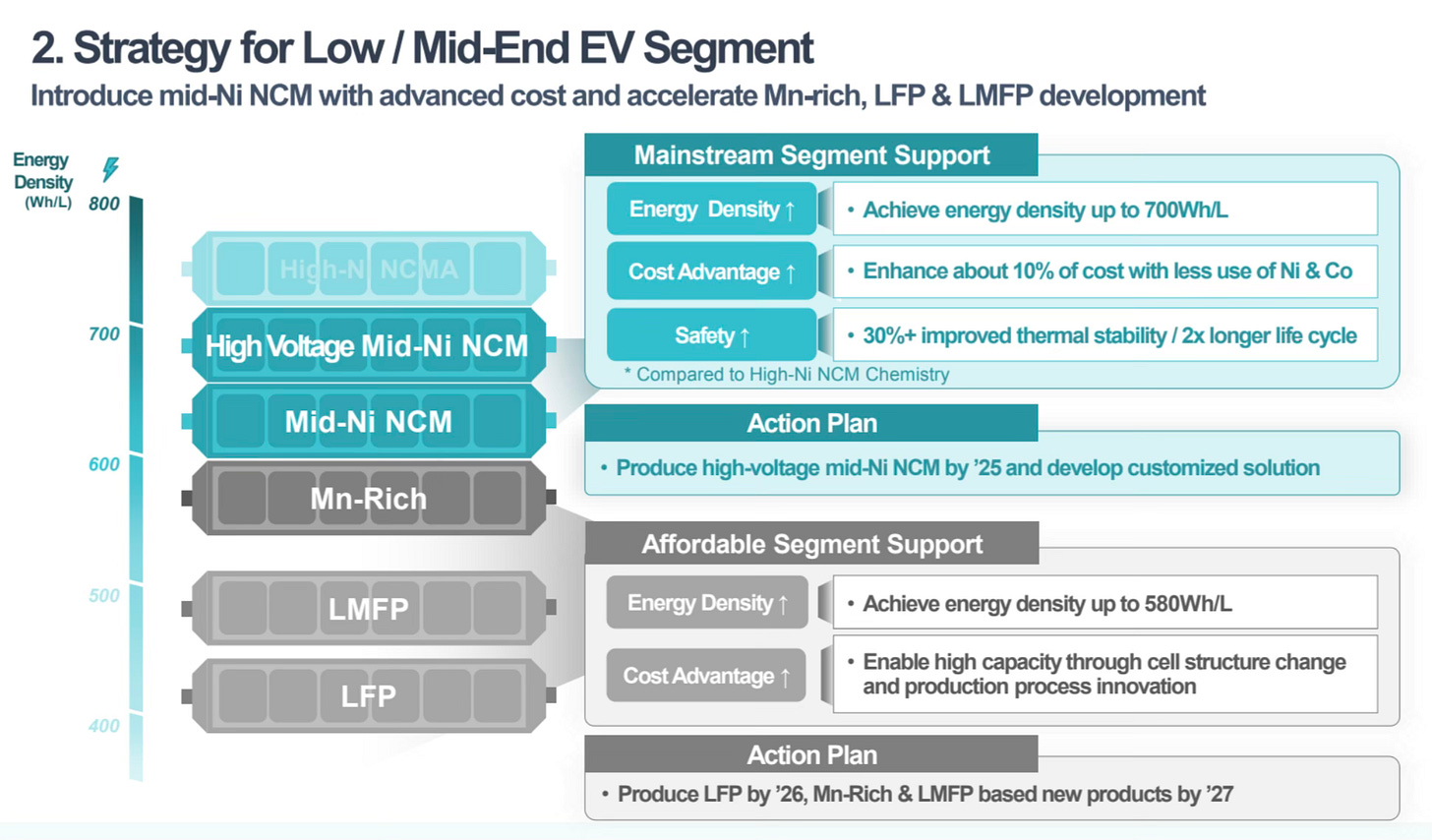

Mid-nickel NCM may lose market share to high-nickel NCM. This trend is already happening. Mid-nickel NCM is not obsolete yet.

High-voltage mid-nickel NCM may change the market. Its energy density could nearly match high-nickel NCM. Higher voltage can cause cracks in the cathode particles. This can reduce durability and lifespan. Using single crystals can limit reactivity. This change increases energy density by 10% and lifespan by 30%.

LFP & LMFP & Managenese-rich (Mn-rich)

LG Energy Solution is well known for its NCM chemistry. LFP is almost exclusively produced by Chinese battery makers.

Strong demand for LFP batteries leaves LG Energy Solution no choice but to add this chemistry to its portfolio. LGES plans to start mass production of LFP batteries for energy storage systems in the United States in the second half of 2025.

LMFP and Mn-rich chemistries are expected by 2027. Many players are developing these new chemistries.

LG Energy Solution will use these chemistries for the affordable EV segment.

LG Energy Solution manufacturing network

In my opinion, LG Energy Solution has the best manufacturing network among the battery makers.

LGES is well positioned geographically to deliver the main markets:

China

Korea

Poland for the European market

Indonesia for the rest of the world

USA and Canada for the North American market

LG Energy Solution strategy

LGES is focused on the North American market. It benefits from the IRA and faces little Chinese competition.

Most battery projects are built with OEMs through joint ventures. This approach de-risks projects and reduces costs. LGES partners with GM (Ultium JV), Stellantis (NextStar Energy JV), Honda, and Hyundai.

Tariffs on Chinese products and US LFP production could help LG Energy Solution lead the ESS market in North America.

LG Energy Solution’s next-generation batteries

LGES is also developing next-generation batteries. These include lithium-sulfur, semi-solid, and solid-state batteries.

Lithium-sulfur batteries are eight times lighter than lithium-ion batteries. They also offer twice the energy density of current lithium-ion technology.

These batteries could change high-performance sectors. They may enable drones to fly longer distances. They could redefine urban air mobility. They might reduce the environmental impact of aircraft.

LG Energy Solution is working on polymer-oxide and sulfide SSBs, aiming for mass production after 2030.

In addition, LGES develop dry coating technology with commercialization in 2028. They expect to cut battery manufacturing costs by 17% to 30%.

LG Energy Solution’s R&D

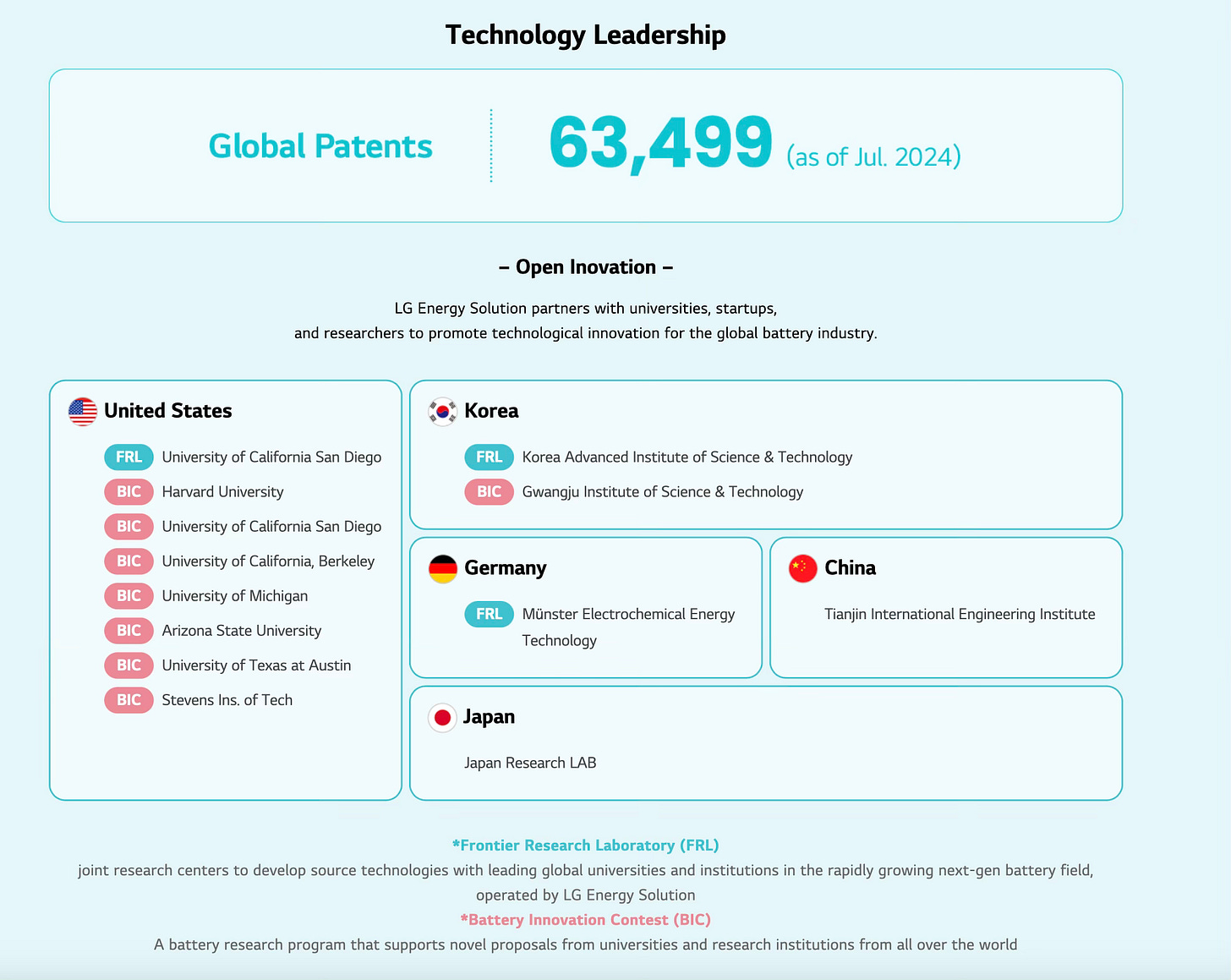

LGES invests heavily in R&D to advance battery technologies. The company has filed over 63,000 patent applications worldwide.

As a strong patent leader, LG Energy Solution wants to establish a fair battery patent licensing market. This will protect its innovative technologies and ensure fair competition. The company is exploring various patent monetization models, including patent pooling and sales.

They also collaborate with several universities worldwide, including those in the USA, Germany, Korea, and China.

LG Energy Solution’s Vertical integration

I often talk about how Chinese battery makers are vertically integrated, especially BYD and CATL. LG Energy Solution is very active too.

LGES invests in the lithium industry. For example, they have invested in Piedmont Lithium and Liontown Resources.

LG Chem produces cathodes and carbon nanotubes for LGES. LG Chem also has a ceramic coating technology called SRS® (Safety Reinforced Separator). They will produce separators with Toray in Europe.

LG Energy Solution has invested in battery recycling with Li-Cycle. In 2023, LG Energy Solution announced its first battery recycling joint venture with Zhejiang Huayou Recycling Technology in China.

Key takeaways:

Strong Manufacturing Network: LGES strategically locates plants in China, Korea, Europe (Poland), North America (USA/Canada), and Indonesia, ensuring efficient global market coverage.

Advanced Battery Chemistries: Focuses on premium NCMA for EVs, high-voltage mid-nickel NCM, and plans to launch LFP, LMFP, and Mn-rich batteries to cover both high-performance, mainstream and affordable segments.

Innovative Next-Generation Batteries: Actively developing lithium-sulfur, semi-solid, and solid-state batteries, targeting improved energy density and increase safety.

Robust R&D and Patent Leadership: With over 63,000 patent filings, LGES drives innovation and aims to foster a fair battery patent licensing market.

Vertical Integration and Strategic Partnerships: Investments in lithium supply, battery recycling, and joint ventures with major OEMs (e.g., GM, Stellantis, Honda, Hyundai) reduce costs and risk, helping to counterbalance Chinese competitors.

LG Energy Solution is the strongest competitor to Chinese battery makers.

Now, let’s look at this week's battery market developments.

Battery Industry Pulse: Weekly Roundup

Metals

Vulcan and BASF form partnership to explore regional geothermal potential

Sibanye walks away from Rhyolite Ridge lithium project on weak prices

Indonesia's Merdeka Battery to build $1.8 billion nickel HPAL plant

Components

Idemitsu has decided to construct a large-scale production facility for lithium sulfide

‘Homegrown’ Swedish battery startup admits importing vital components

Battery

UK battery start-up Volklec unveils plans for £1bn gigafactory

Hyundai Motor to manufacture both prismatic and pouch batteries in Korea

Samsung SDI partners with Hyundai, Kia to develop advanced robot batteries

Mercedes-Benz started road tests with Factorial quasi solid-state battery

Passengers EVs

Battery Recycling

Don’t hesitate to leave a comment or reply to this email to share your feedback. My goal is to make the best newsletter for you.

Thanks. This is an a lot of information. I don't understand it all, but appreciate you giving the reasons why you like LG. however, I'm less than convinced that the long range future for (large) batteries is good. I think the EV market is peaking and also the renewable grid size backup battery market won't keep growing at the previous rate. The subsidies cannot continue forever.