LMR cells deliver 33% more energy density than LFP at similar cost

A new battery chemistry is coming soon in the EV world.

Welcome back to another edition of my newsletter! - Week 20 2025

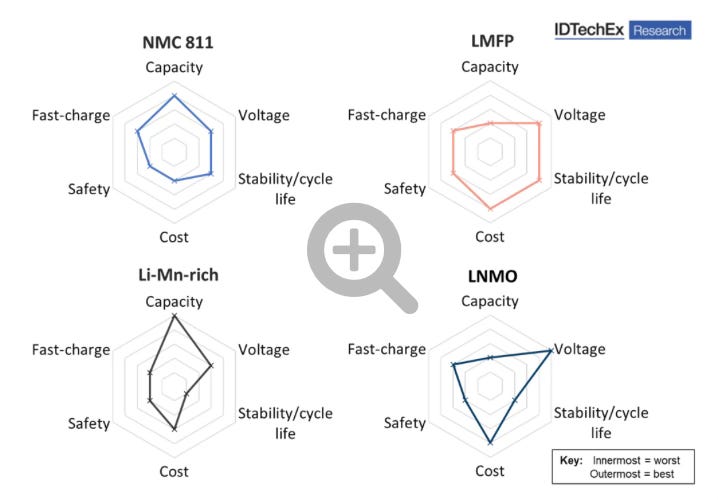

The lithium-ion battery industry is always in motion, with new chemistries entering the market. You’ve probably heard of LFP (Lithium Iron Phosphate), NMC (Nickel-Manganese-Cobalt), NCA (Nickel-Cobalt-Aluminum), and LCO (Lithium-Cobalt-Oxide).

These are the “classic” chemistries already on the market. What I like about the lithium-ion battery industry is the sheer number of possibilities for new options.

Have you heard of LMR (Lithium-Manganese-Rich)? It’s an emerging chemistry that’s coming soon to market.

Summary

The highlight of the week: LMR, a great potential for EVs

Battery Industry Pulse: Weekly Roundup.

The highlight of the week: LMR, a great potential for EVs

LMR is part of the high-manganese content family: LMO, LMFP, LMNO.

The latest two chemistries, like LMR, are not yet in mass production or widely present on the market.

LMR is quietly entering the EV market.

Why? Only a few OEMs and battery makers have explicitly announced LMR commercialization. Others have announced high-manganese chemistries but haven’t specified exactly which.

LGES and GM announcement

This week, LG Energy Solution and General Motors officially announced the commercialization of lithium manganese-rich (LMR) prismatic battery cells.

They will be installed in future GM electric trucks and full-size SUVs.

The cells will be produced through their joint venture, Ultium Cells, in the USA in 2028. LGES will begin pre-production alone in 2027. LG Energy Solution holds the largest LMR-technology IP portfolio globally, with over 200 patents, the first dating back to 2010. GM began researching manganese-rich lithium-ion cells in 2015.

This underscores that bringing a new chemistry to market takes time, over 15 years for LMR.

Chemical composition

According to GM:

With a typical high-nickel battery cell, the chemical composition is roughly 85% nickel, 10% manganese, and 5% cobalt. The composition of LMR cells is much different – around 35% nickel, 65% manganese, and virtually no cobalt.

That said, actual compositions can vary by producer: generally 60–70% manganese, 0–2% cobalt, and 30–40% nickel.

Benefits of LMR technology

Lower cost vs high-nickel chemistry: High manganese is abundant and low-cost, though refining it into manganese sulfate is dominated (>90%) by China. It’s an overlooked metal compared to lithium and nickel.

Less or no cobalt.

Safety and stability: Ford claims to have achieved a safety profile comparable to Lithium Iron Phosphate (LFP) batteries.

Higher energy density: GM cites 33% more energy than top LFP cells at comparable cost; Ford claims LMR beats even high-nickel batteries.

Challenges of LMR technology

The main issue is voltage decay. The operating voltage drops over charge–discharge cycles, reducing usable capacity. It arises from:

Oxygen loss weakens the cathode

Metal-atom migration degrades the structure

Cracks impeding lithium flow

These factors shorten cycle life. However, mitigation strategies exist. GM states:

“We’ve worked with our suppliers to optimize the materials in our LMR cells, adding proprietary dopants and coatings, along with particle engineering, process innovations, to achieve the right energy density and arrangement of battery materials inside the cell to keep them stable. The result is that our new LMR cells can match the lifespan of current-generation high-nickel cells, with comparable performance but much lower cost.”

Other Players (non-exhaustive list)

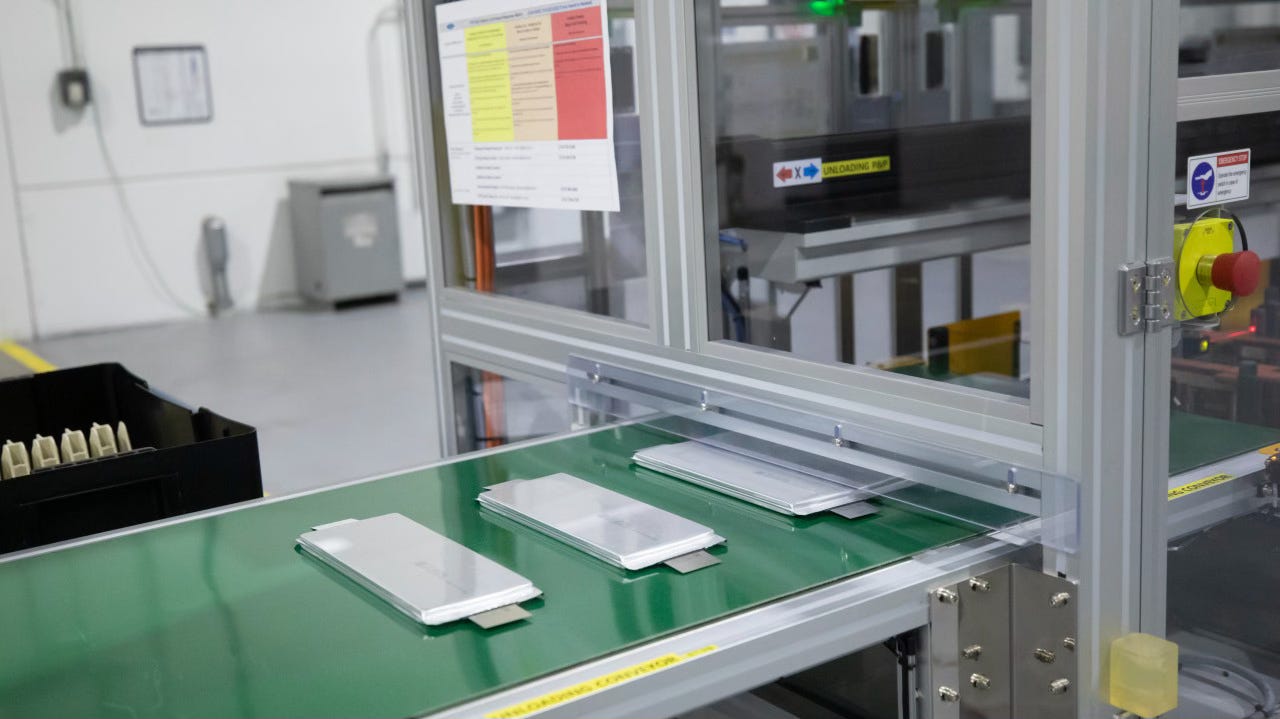

Ford: last month, Charles Poon, the director of electrified propulsion engineering at Ford said his team has developed a Lithium-Manganese-Rich (LMR) cell chemistry at its Ion Park battery research and development center in Romulus, Michigan. Ford is now already producing a second generation of these cells on a pilot line in Michigan. They are developing the technology alone, without a battery maker.

BASF is working on several manganese-rich products like NCM217 and NCM307.

Umicore is quite advanced on this technology as well. Two year ago, Umicore announced starting the industrialization of its manganese-rich HLM (high lithium, manganese) cathode active materials (CAM) technology and targets commercial production and use in electric vehicles (EVs) in 2026.

Key Takeaways:

LMR Overview: A new high-manganese battery chemistry (30–40% Ni, 60–70% Mn, ~0-2% Co) in the same family as LMO/LMFP/LMNO.

Market Status: Not yet mass-produced; only a few OEMs (GM, Ford) and LGES have publicly committed to commercialization.

Key Announcement: LG Energy Solution and GM will start LMR cell pre-production in 2027 and full output via Ultium Cells in 2028 for electric trucks/SUVs.

Advantages: Lower cost (abundant manganese, minimal cobalt) and improved safety/stability vs high-nickel chemistry, higher energy density (33% above top LFP).

Main Challenge: Voltage decay over cycles. It’s addressed by GM through advanced dopants, coatings, and process optimizations to match high-nickel cycle life.

Other Players: Ford (pilot LMR cells), BASF (NCM217/307), Umicore (HLM CAMs targeting 2026 EV use).

Now, let’s look at this week's battery market developments.

Battery Industry Pulse: Weekly Roundup

Components

Battery

Tesla battery supplier feels pressure to expedite US production

CATL Seeking to Expand Battery Supply to Hyundai Motor and Kia

Battery Equipment

Battery Recycling

Altilium demonstrates battery cell production with recycled cathode materials

Fortum Battery Recycling and Vianode join forces to recycle graphite from end-of-life EV batteries

SK Ecoplant scraps plan for battery recycling plant in the US

Passengers Cars

CATL to offer skateboard chassis to Mazda’s China joint venture

Honda puts EV and battery production plans for Canada on ice

Commercial Vehicles

BYD Ride electrifies Oakland Int’l Airport shuttle bus fleet

Half of China's heavy truck sales could be EVs by 2028, Chinese battery maker CATL says

Other Applications

Charging infrastructure

🤝 For newsletter sponsorships - Click here

Thanks for the summary! I was wondering about the “virtually” Co free statement.

I have learned that Co is also just an impurity in Mn and Ni mining and hence the “virtual”. But you mention up to 2% Co, that’s a large amount of impurity. Do you know more about that?

And do you know the estimated cycle life? I guess if 1000 cycles are doable, that should be fine for warranties.

As I understand the development, LGES and GM have not solved any of the well known major technical problems hindering the commercialization of the LMR chemistries, they have just found a regime that slows down the battery deterioration enough for GM to meet its warranty commitment. Have you found any insight into what they are actually doing?

United States Federal Warranty Requirements (Clean Air Act)

Under EPA regulations, electric vehicle manufacturers must provide warranties for emissions-related components, which include the traction or motive battery in EVs.

Battery Warranty Requirements:

Minimum duration: 8 years or 100,000 miles, whichever comes first.

Coverage: Must cover defects in materials and workmanship that would cause the vehicle to fail to meet emission standards.

Applies to: All manufacturers selling EVs in the U.S.

🌿 California & CARB States Warranty (Stricter Standards)

California, through the California Air Resources Board (CARB), has stricter requirements, and several states have adopted these under Section 177 of the Clean Air Act.

CARB ZEV Warranty Requirements (for BEVs, PHEVs, FCEVs):

Battery warranty: 10 years or 150,000 miles for the battery and certain other components (whichever comes first).

Degradation standards:

Some CARB regulations require the battery to retain at least 70–80% capacity during the warranty period.

Covered states:

As of 2025, CARB-aligned states include CA, NY, NJ, MA, OR, WA, and others (a total of ~17 states).