Solid-state batteries: why mass production won’t happen before 2027 (and who’s leading the global race)

Every week, the battery landscape shifts in fascinating ways — this one is no different.

Welcome back to another edition of my newsletter! - Week 7 2025

In this new edition, we explore the world of solid-state batteries. A potential game changer for the battery industry. It could offer double the capacity of today’s lithium-ion batteries, enabling EVs to surpass 1,000 km ranges. Yet, manufacturing hurdles: material instability, high costs, and scalability challenges, keep mass production years away.

Summary

Special topic: solid-state batteries are the game changer

Battery Industry Pulse: Weekly Roundup.

Special topic: solid-state batteries are THE game changer

Solid-state batteries (SSBs) promise energy densities of 300–500 Wh/kg, doubling the capacity of today’s lithium-ion batteries (150–250 Wh/kg). This advancement could enable EVs to achieve 1,000+ km ranges on a single charge.

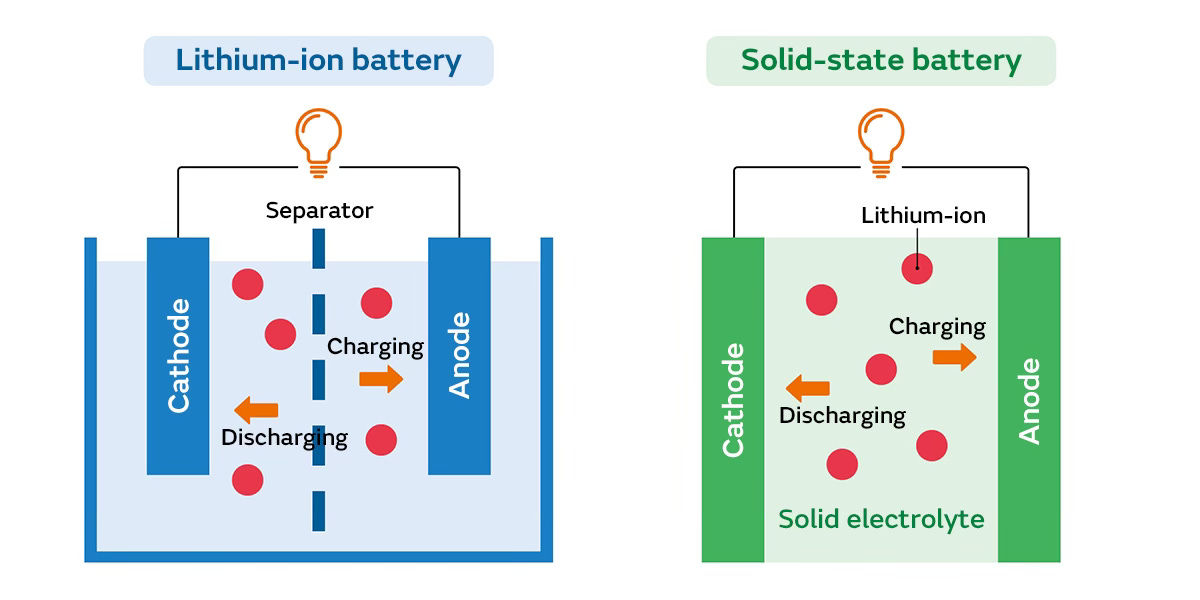

Manufacturing SSBs, however, remains complex and costly. Unlike traditional lithium-ion batteries, SSBs rely on solid electrolytes, which pose challenges in material stability, ionic conductivity, and scalability.

Processing methods vary by technology:

Polymer-based SSBs require elevated temperatures for optimal conductivity, complicating integration into EVs.

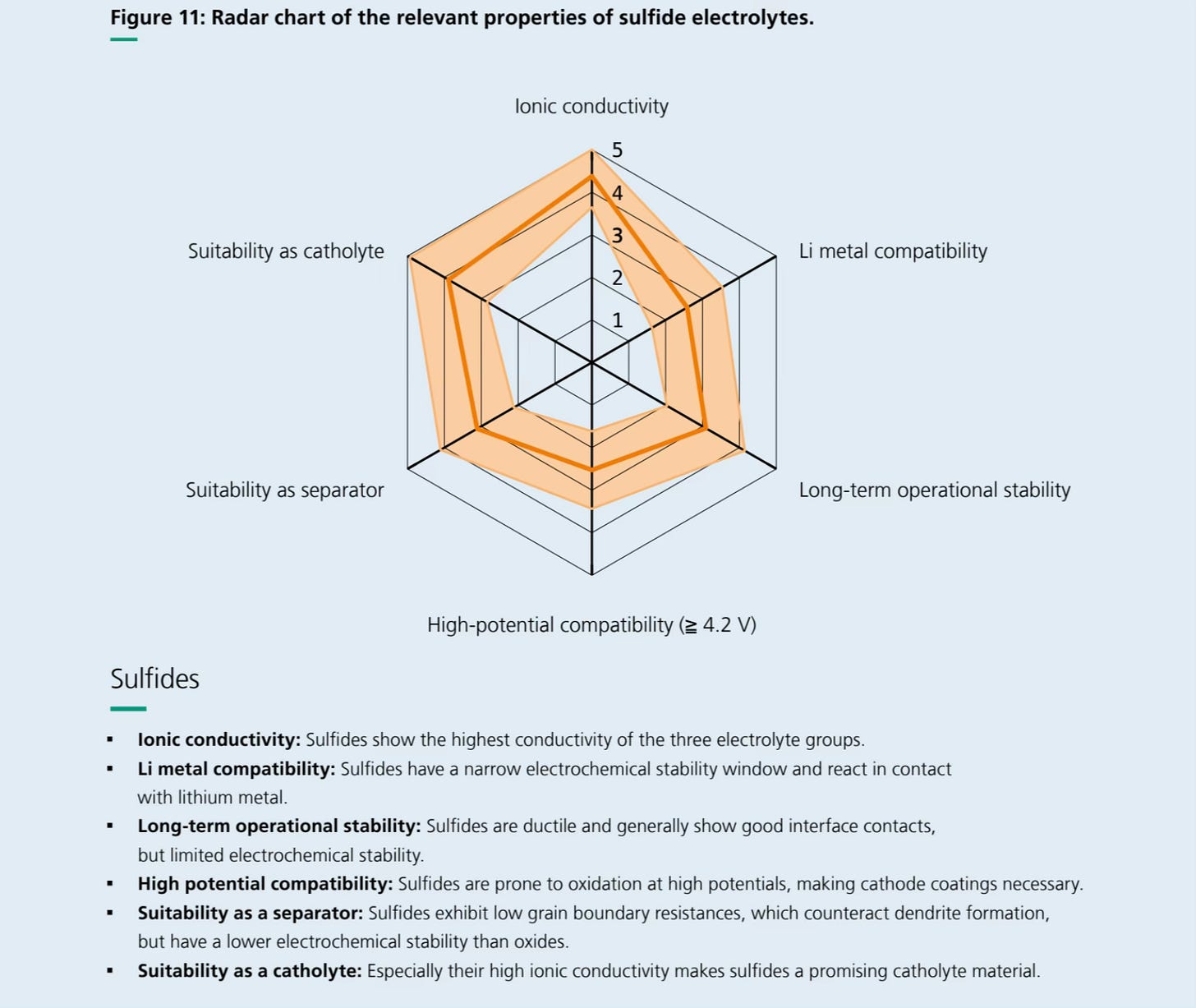

Sulfide-based SSBs offer high ionic conductivity but struggle with moisture sensitivity and dendrite formation.

Oxide-based SSBs provide structural stability but face high interfacial resistance, necessitating advanced manufacturing techniques.

SSBs must surpass lithium-ion batteries (LIBs) in energy density, safety, cost, and scalability to compete.

Global players: who’s leading the solid-state race?

The global push for solid-state batteries is divided by technology focus and industrialization progress.

(list non-exhaustive).

🇪🇺 Europe: strong R&D, slow industrialization

Blue Solutions (France) is the only company mass-producing polymer-based SSBs since 1997. The company has two factories in Canada and France with annual capacity of 1.5 GWh. They supply for electric buses. Blue Solutions intends to supply the passenger cars with its next generation batteries, in the future.

Ilika (UK) specializes in oxide-based SSBs, targeting EVs and medical applications. The British company has reached an important milestone. With its 10 Ah cell, capacity has increased fivefold since July.

Iten (France) is a French company focused on micro solid state cells. Iten has already a pilot line in France with focus on oxide-based material.

SOLiTHOR (Belgium) is developing nano-solid composite oxide electrolyte with lithium metal. Targeting aviation and maritime applications.

Prologue (Taiwan) plans to build a battery plant in France (€5.2 billion investment). They already have a pilot plant in Taiwan. The company is working on oxide-based cells.

Europe has experience in mass production through Blue Solutions but lacks industrial-scale oxide and sulfide SSB production.

🇺🇸 USA: strong start-up companies

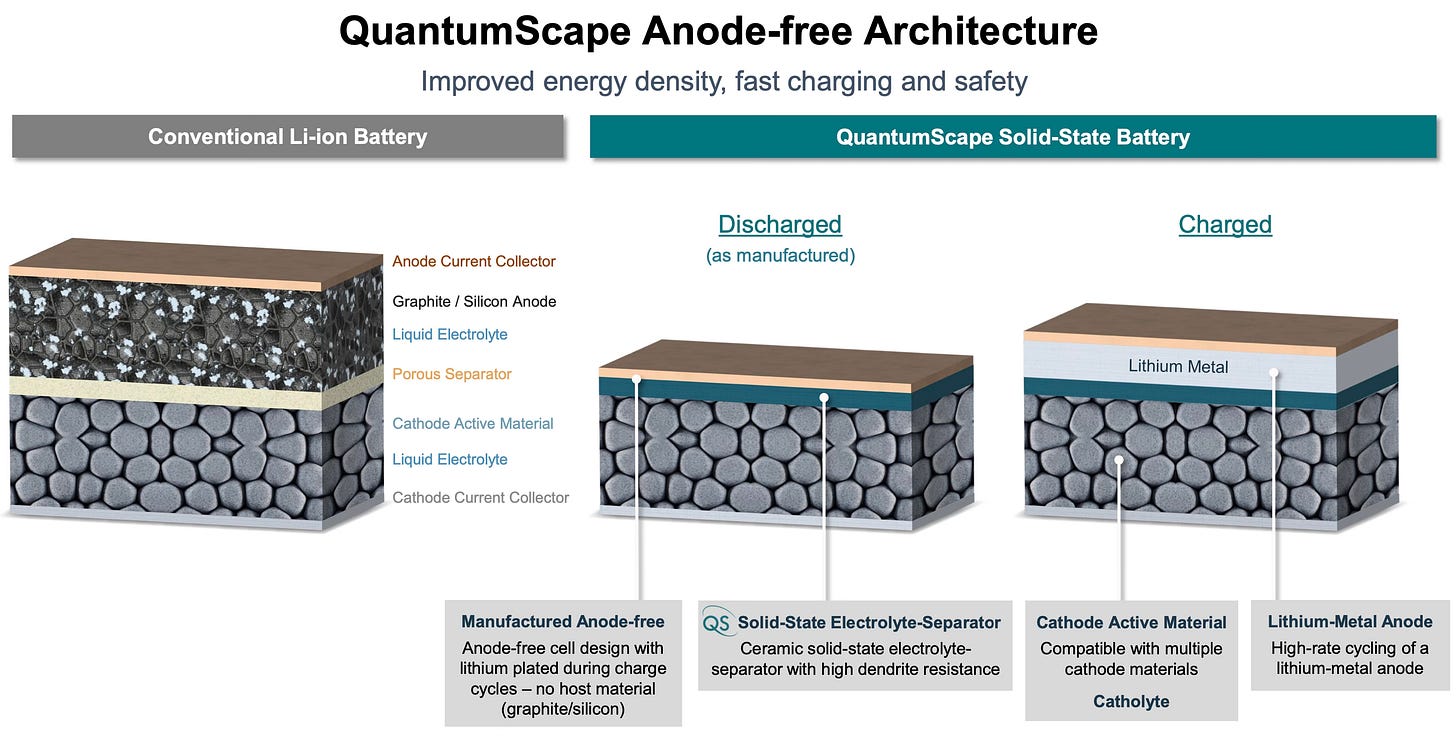

QuantumScape (USA) is focused on lithium-metal SSBs with ceramic separators (oxide-based). Targeting mass production by 2026-2028. The American company is in close collaboration with PowerCo (VW group).

Solid Power (USA) is developing sulfide-based SSBs. Partnered with Ford and BMW, with pilot production operational. Aims for mass production post-2027.

Factorial Energy is working on polymer solid-state cells, with Stellantis partnership for EV testing in 2026.

The US is investing heavily in R&D, but large-scale production remains years away. The start-up companies rely strongly on OEM automotive partnerships.

🇨🇳 China: scaling up fast

CATL is advancing sulfide-based SSBs, targeting small-scale production of its all-solid-state battery by 2027. Prototypes already achieve 500 Wh/kg, supported by a dedicated R&D team of 1,000+ members and significant investment.

BYD rolled off 60Ah all-solid-state batteries from its pilot line in 2024. The company plans mass demonstration and installation by 2027, with large-scale deployment post-2030.

Gotion High-Tech unveiled a battery with 350 Wh/kg energy density in May 2024, enabling 1,000 km per charge. It aims for in-vehicle trials by 2027 and mass production by 2030.

EVE Energy is developing sulfide-halide SSBs, targeting 400 Wh/kg by 2028.

SAIC announced plans to mass-produce 400 Wh/kg all-solid-state batteries starting in 2026, with volume delivery beginning in 2027.

FAW has developed a 20Ah prototype with 375 Wh/kg, targeting small-scale demonstration production in 2027.

Geely has achieved 400 Wh/kg in its all-solid-state battery and completed development of 20Ah cells.

China is leveraging its lithium-ion dominance to accelerate SSB production.

🇯🇵 Japan: the patent leader

Toyota holds the most SSB patents globally (more than 1,300 solid-state battery patents). The Japanese company is developing sulfide-based SSBs with 1,000 km range and 10-minute fast charging. Mass production set for 2027-2028. Toyota collaborates with Panasonic.

Nissan has a pilot production line operational at Yokohama Plant with targets for commercial EVs by 2029. Focus on extreme temperature resilience and 20% cost reduction vs. lithium-ion batteries

Honda is running a pilot plant in Sakura to develop SSBs for automotive and aerospace use.

Japan is focusing on long-term, high-energy-density SSBs.

🇰🇷 Korea: industrializing SSBs

In 2023, Samsung SDI completed the world's biggest pilot production line for solid-state batteries. SDI is developing sulfide-based SSBs with 500 Wh/kg prototypes, targeting commercialization by 2027.

LG Energy Solution is working on polymer-oxide and sulfide SSBs, aiming for mass production post-2030.

SK On is developing hybrid oxide and sulfide SSBs, with a pilot plant launching by 2025 and mass production by 2029.

Hyundai’s all-solid-state pilot line will begin full-scale production next month. Industry sources expect Hyundai will release a prototype powered by the new EV batteries by the end of 2025. Hyundai aims to begin mass-producing all-solid-state batteries around 2030

Korea’s battery giants are investing in both R&D and production scaling, positioning themselves as key SSB suppliers.

Key takeaways: where is solid-state tech headed?

Mass production remains years away. Only polymer SSBs are in commercial production. Oxide and sulfide SSBs are still in pilot phases, with commercialization expected post-2026.

China is leading in industrialization. Its aggressive roadmap could make it the first to mass-produce sulfide SSBs.

Japan holds the most patents. Toyota, Nissan, and Honda are pushing for high-energy-density SSBs, but commercial viability is years away.

Europe is strong in R&D but weak in production. While leading in oxide SSB research, it lacks industrial capacity for next-gen SSBs.

The US relies on QuantumScape and Solid Power to commercialize SSB by 2026-2028, but scalability remains uncertain.

Solid-state batteries are the future, but large-scale adoption will take time. Expect 2026-2030 to be the critical period for breakthroughs in cost, production, and commercialization.

Now, let’s look at this week's battery market developments.

Battery Industry Pulse: Weekly Roundup

Metals

Lyten secures domestically sourced sulfur to supply its US lithium-sulfur manufacturing facilities - link

CarbonScape achieves 90% spheroidization yield in battery-grade graphite production - link

Components

L&F develops LFP cathode with high pressed density - link

Battery

Hyundai-Kia buys more batteries from SK On in the US - link

Tata Group’s UK battery cell plant to open in 2026 - link

Volvo seeks new battery supplier in the US - link

LG Energy Solution has developed a technology that can increase the charging speed of solid-state batteries - link

CATL files for at least $5 billion Hong Kong listing - link

Stellantis could use LFP batteries from BYD - link

Battery recycling

tozero achieves industrial-scale graphite recovery - link

BESS

NGEN commissions Austria’s largest battery storage system - link

Commercial EVs

Isuzu will build new EV truck factory in the U.S. - link

Other applications

Archer Raises $300M to accelerate hybrid aircraft platform development - link

Charging infrastructure

Nio's swap stations in Shanghai close to profitability, CEO says - link

Don’t hesitate to leave a comment or reply to this email to share your feedback. My goal is to make the best newsletter for you.

Question: is there a number at which the energy density starts to make sense for prop driven aircraft?

Nice article but I would not agree that "Europe ... leading in oxide SSB research, it lacks industrial capacity for next-gen SSBs." rather Europe (especially, France) is strong in polymer based SSB.