The EV market isn’t dying: here’s why it’s still going strong.

Every week, the battery landscape shifts in fascinating ways — this one is no different.

Welcome back to another edition of my newsletter! - Week 3 2025

This week, we continue our exploration of the fast-evolving battery industry, where new developments are constantly shaping the future of energy.

It was another busy week for the battery industry.

I'm thrilled to bring you valuable insights and the latest updates!

Summary

The Highlight of the week: The EV market isn’t dying

Battery Industry Pulse: Weekly Roundup.

The Highlight of the week: The EV market isn’t dying

Lithium-ion battery demand is primarily driven by the electric vehicle (EV) market.

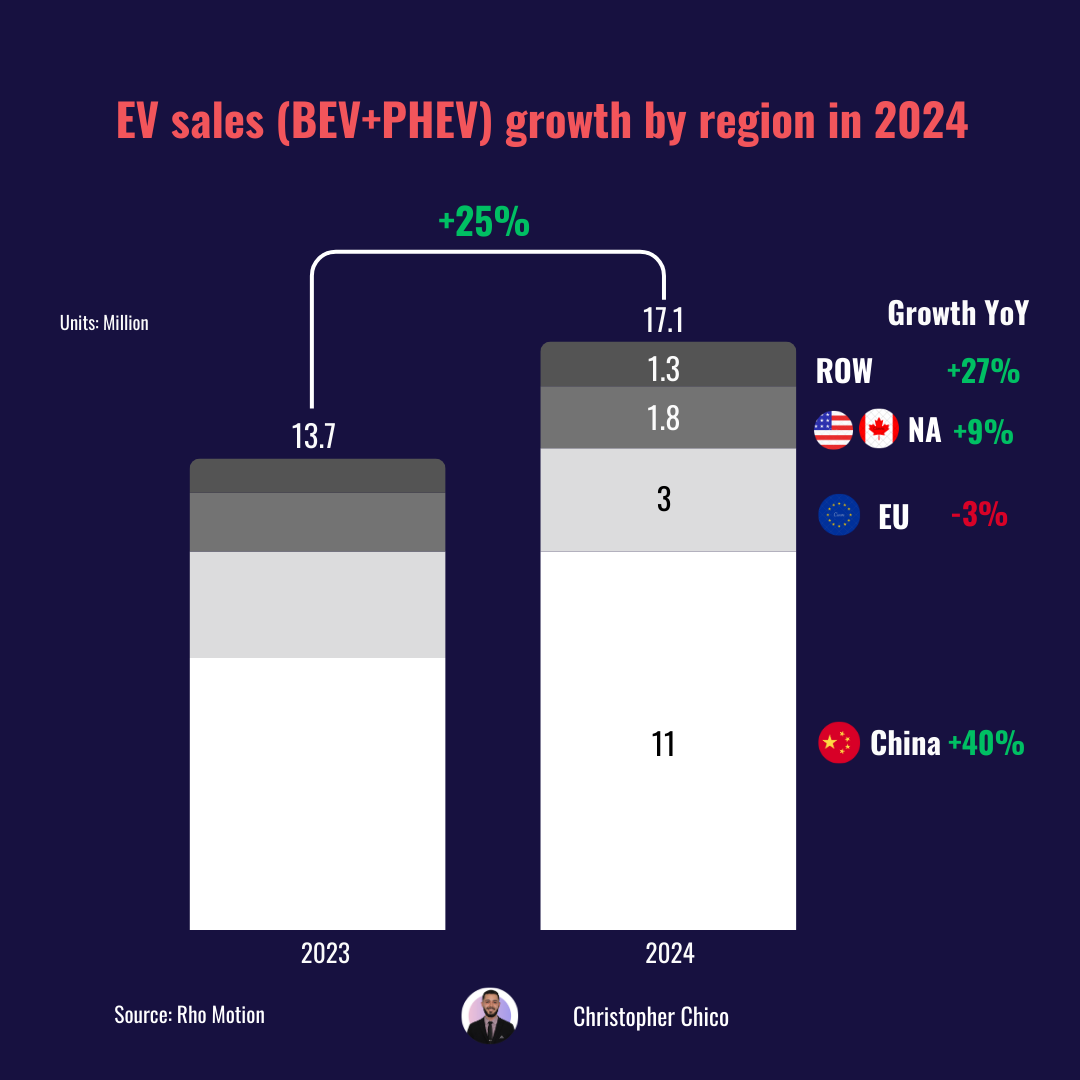

Rho Motion reports that this market, comprising both BEVs and PHEVs, saw a 25% year-over-year growth in 2024, with 17.1 million vehicles sold.

The regions have a different dynamic:

China's EV market is booming, with a 40% year-over-year surge in sales in 2024, reaching 11 million vehicles. In addition, China exported 1.28 million EVs in 2024, a 6.7% increase.

A major contributor to this growth is the affordability of EVs in China. Almost two-thirds of EVs in China are already cheaper than their ICE equivalents. It’s a direct result of China's dominance in the battery supply chain. This allows manufacturers to offer technologically advanced EVs with strong digital features at competitive prices.

China's government is aggressively promoting the adoption of electric vehicles through regulations and subsidies. EV sales are expected to surpass internal combustion engine (ICE) vehicle sales for the first time in 2025.

The market landscape is dominated by BYD, with retail sales of 3.7 million NEVs and a 34.1% market share. Geely and Tesla follow, achieving 862,933 and 657,102 retail sales respectively, translating to market shares of 7.9% and 6.0%.

Europe's EV market underperformed in 2024, recording a 3% year-over-year decrease to 3 million units. A lack of affordable vehicles is a major barrier, with most appealing EVs priced over €40,000.

Germany experienced a sharp 20% decline due to subsidy removals. Tesla sales (37,574 BEVs sold) dropped by 41%. However, the UK emerged as the largest BEV market in Europe with a 19.6% market share. The government with its ZEV mandate has encouraged manufacturers to prioritize low-emission vehicle production.

In 2024, 1.8 million EVs were sold in the US and Canada, representing a 9% increase from the previous year. Growth is happening, which is positive. However, it's much slower than last year's 50% increase because of high interest rates and affordability problems.

Despite some challenges, the EV market is still strong in terms of sales volume. Tesla's Model Y and Model 3 were the driving force behind that, capturing more than 40% of the market even with slight sales declines.

Rest of the world reached 1.3 million EVs sales, representing a 27% YoY growth.

Source data: Rho Motion, CAAM, CPCA, KDA, SMMT

Now, let’s look at this week's battery market developments.

Battery Industry Pulse: Weekly Roundup

Metals

Mining giant Rio Tinto plans to create a standalone lithium division - link

Aramco plans transition minerals JV with Ma’aden including lithium extraction exploration - link

Ioneer has closed a $996M U.S. DOE loan under the ATVM program to develop an on-site processing facility at its Rhyolite Ridge Lithium-Boron Project in Nevada - link

Altilium and HELM AG sign memorandum of understanding to strengthen the UK's lithium supply chain - link

Components

ICL has signed a JV agreement with Dynanonic to establish LFP cathode active material production in Europe - link

Vianode signs USD multi-billion long-term supply agreement for EV battery-grade anode graphite with GM - link

Battery

CATL breaks ground on its 1st battery swap station in HK - link

SK On Unveils R&D Breakthroughs on All-Solid-State Batteries - link - LinkedIn post for a summary.

CATL takes CALB to court over alleged patent violation - link

Amprius announced a new SiCore™ cell as part of its expanding SiCore product platform - link

Morrow Batteries is implementing strategic measures to secure the start-up of production of commercial LFP batteries - link

Battery recycling

The BMW Group is launching a closed-loop battery recycling ecosystem together with SK tes - link

BESS

Tesla lands $87 million Megapack project in Belgium - link

Commercial EVs

Amazon has placed an order for “more than” 200 eActros 600 from Daimler Trucks - link

Charging infrastructure

Mobilize and NW announced the signing of an agreement to create a joint venture in electric vehicle charging combined with energy storage - link

Don’t hesitate to leave a comment or reply to this email to share your feedback. My goal is to make the best newsletter for you.

Very insightful. As china restricts the process of technology outside China, JV with ICL and Dynanonic, is challenging to see outcome of progress

Nice roundup!