It’s been just over six months since I launched this newsletter, and I'm thrilled to see so many of you joining me on this journey. Thank you all for your support. It means a lot to know that my work is being read. I'm starting to reflect on this newsletter, and I'd greatly appreciate your feedback, whether positive or negative. I hope you enjoy today's edition below.

Summary

Trump’s New Bill is shaking up the EV, Battery and BESS industries

Battery Industry Pulse: Weekly Roundup.

Welcome back to another edition of my newsletter! - Week 27 2025

Since President Trump returned to office this year, the electric vehicle (EV), battery, and energy storage industries have faced a lot of uncertainty. Here's why.

The Tariff Trouble

Trump's administration kicked off the year by ramping up tariffs, especially targeting China. The problem? Most battery materials and components come from China, Korea, and Japan. The result is straightforward: EVs and energy storage projects in the U.S. are getting more expensive.

This constant back-and-forth on tariffs has caused companies to pause their plans. For example, battery maker AESC has paused construction at its South Carolina plant, and several silicon-anode startups have cut back or stopped production at their pilot plants due to higher tariffs.

Subsidies Under Threat

During his campaign, Trump made it clear he wasn’t a fan of EV subsidies. Now he's acted on that promise. On July 4th, he signed the One Big Beautiful Bill (OBBB), dramatically cutting support for clean energy.

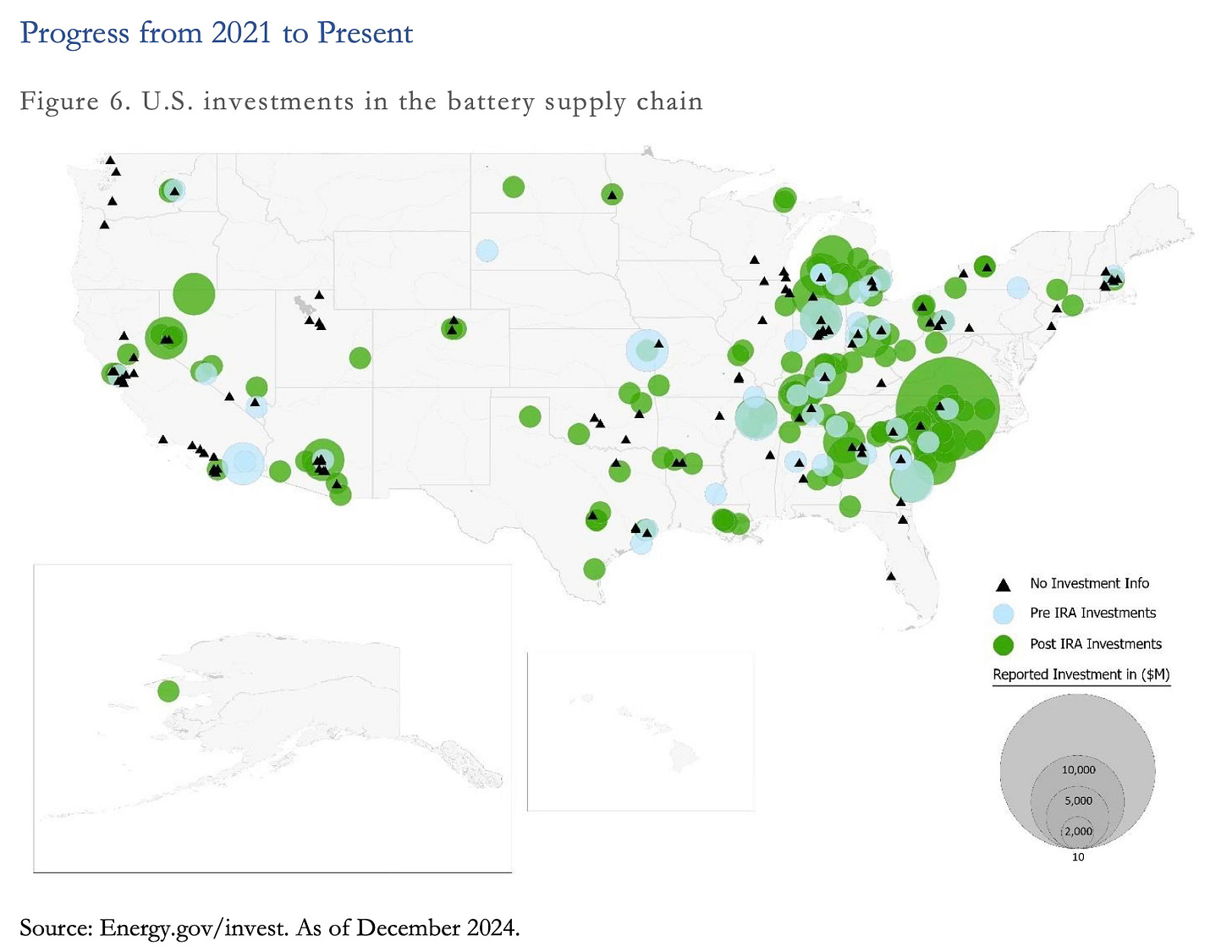

This move could be a big setback. The U.S. had been building momentum thanks to Biden’s Inflation Reduction Act (IRA). That act spurred major investments, especially in battery factories and EV manufacturing.

What the IRA Did

The IRA, signed by Biden in 2022, was all about supporting clean energy and reducing carbon emissions. It encouraged companies to build factories in the U.S. by offering loans, grants, and tax credits.

And it worked. Since the IRA launched, companies have committed around $125 billion to build EV and battery plants in the U.S.

And according to Rho Motion, about half of all EV sales this year qualified for the $7,500 tax credit, making EVs more affordable for regular people.

One Big Beautiful Bill Act

The OBBB removes many key incentives that drove growth:

Without these incentives, buying an EV will become tougher again. Even before the new bill passed, Rho Motion had already lowered its U.S. EV sales forecast by about 42% for the period 2025-2030, anticipating policy shifts under Trump's administration.

Jobs at Risk

It’s not just sales that could suffer. The International Council on Clean Transportation says repealing these credits could cost around 130,000 automotive jobs by 2030, with another 310,000 jobs indirectly affected. Many of these jobs are in red states, ironically, states that support Trump.

LFP Batteries Face Big Obstacles

Companies like Ford, Tesla, LG Energy Solution, and Samsung SDI are betting on lithium iron-phosphate (LFP) batteries. These batteries don’t use expensive metals like nickel or cobalt, so they're cheaper and safer.

But there’s one big issue: 99% of LFP material comes from China. Under Trump’s new bill, using these Chinese materials means losing critical tax credits (45X). So building these batteries in the U.S. just got much harder.

BESS Projects Hit Hard

Battery Energy Storage Systems (BESS) also heavily rely on LFP batteries. Around 80-90% of these storage projects use Chinese cells. Under the new rules, these projects face three big hits:

Higher tariffs on Chinese cells

No 45X production tax credits

No tax credits for systems paired with solar or wind

While demand for battery storage is still strong, the pace of new projects will slow dramatically. The U.S. was starting to pull ahead in storage, but now risks falling back.

A Step Backward

Trump’s bill claims to support American jobs, but in reality, it's likely to do the opposite for clean energy industries. With the IRA, the U.S. was catching up to Europe in building a domestic battery industry. Now Europe and China will likely leave the U.S. behind.

The EV revolution is still happening, just maybe not in America.

Now, let’s look at this week's battery market developments.

Battery Industry Pulse: Weekly Roundup

Metals

Battery

LG Energy Solution is going pouch LFP in ESS market, while the rest offers prismatic

Global EV battery market share in Jan-May 2025: CATL 38.1%, BYD 17.4%

Tesla unveils its LFP battery factory, claims it’s almost ready

Svolt Energy Thailand plant rolls off 10,000th EV battery pack

Here’s Why The Xiaomi SU7 Mounts Its Battery Cells Upside Down

BESS

Passengers Cars

🤝 For newsletter sponsorships - Click here