Trump's tariff hike: what it means for the U.S. battery and ESS market?

Every week, the battery landscape shifts in fascinating ways — this one is no different.

Welcome back to another edition of my newsletter! - Week 14 2025

This week, I’ll be discussing the impact of the new U.S. tariffs on the battery industry. The U.S. imports battery cells from China, South Korea, and Japan, with the Energy Storage Systems (ESS) market being the most affected by these tariffs. China is particularly targeted, which will have significant implications on LFP cells.

Summary

The highlight of the week: How Trump's tariff hike impacts the U.S. battery and ESS market.

Battery Industry Pulse: Weekly Roundup.

The highlight of the week: how Trump's tariff Hike impacts the U.S. battery and ESS market.

Last Tuesday, U.S. President Trump declared “Liberation Day” as his administration announced the most sweeping tariff hike since the Smoot-Hawley Tariff Act of 1930, a policy widely remembered for igniting a global trade war and worsening the Great Depression.

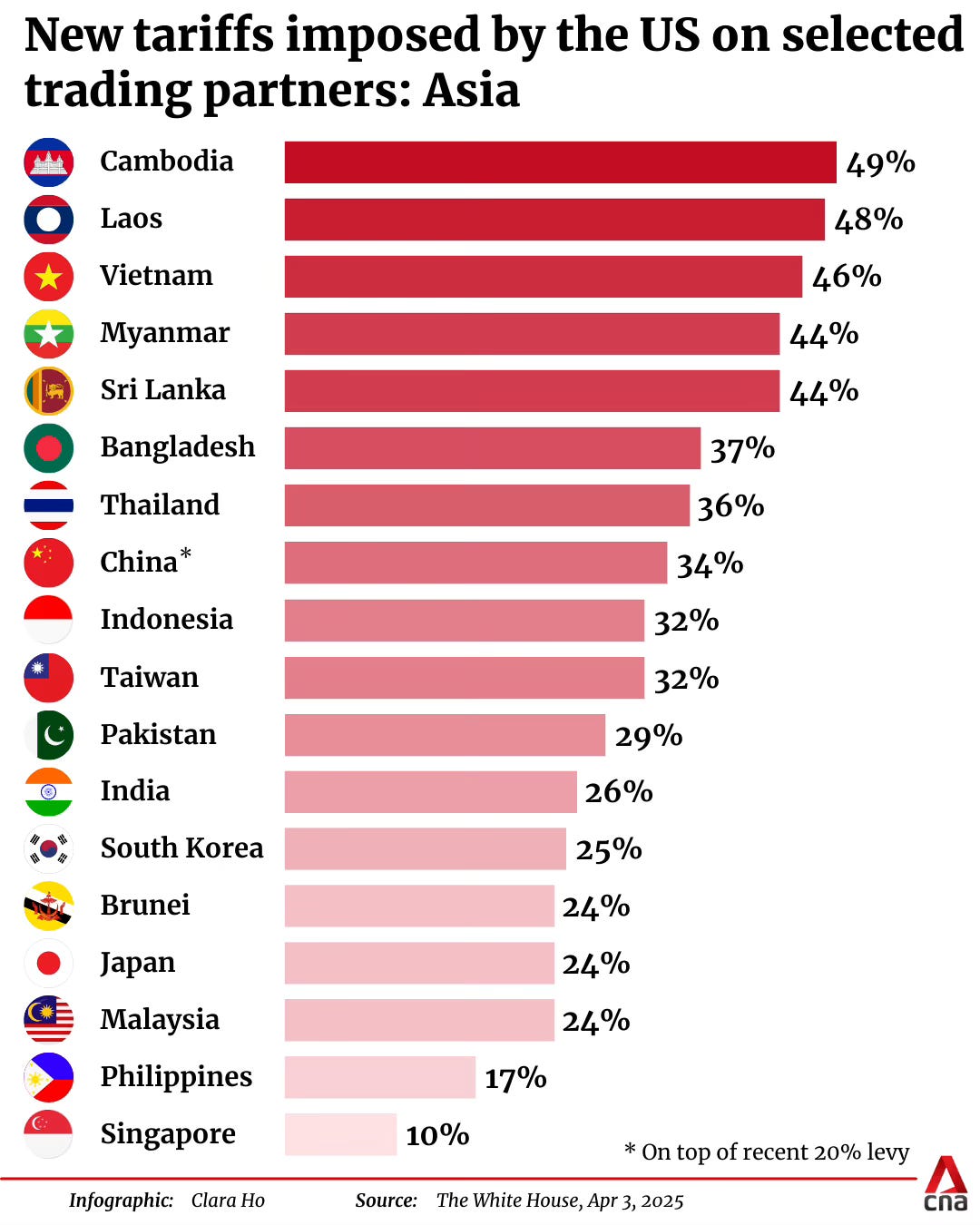

Starting April 2, 2025, the U.S. will implement broad-based tariffs ranging from 10% to 50%.

China, South Korea, and Japan are among the countries most affected, particularly China. In fact, the U.S. had already imposed two rounds of 10% tariffs on Chinese goods in February and March. In total, Chinese imports will now face an additional 54% in tariffs.

These new measures will have a significant impact on several industries, especially energy storage and battery manufacturing.

Why highlight China, South Korea, and Japan? Because these three countries dominate the global lithium-ion battery value chain, producing all four critical components: electrolyte, cathode, anode, and separator.

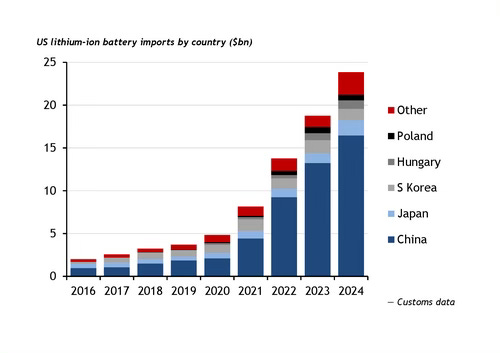

According to 2024 trade data, the U.S. imported $23.8 billion worth of battery cells, primarily from these three countries. China alone accounted for 70% of the total, exporting $16.45 billion worth of battery cells to the U.S. Japan contributed $1.7 billion, and South Korea $1.3 billion (Source: Argus Media).

A large portion of the Chinese battery cells imported into the U.S. are destined for the fast-growing Energy Storage Systems (ESS) market. This segment has shown a strong preference for LFP (lithium iron phosphate) cells, primarily due to two key factors: cost-effectiveness and long cycle life. Among available technologies, LFP stands out as the optimal solution for balancing affordability with performance durability.

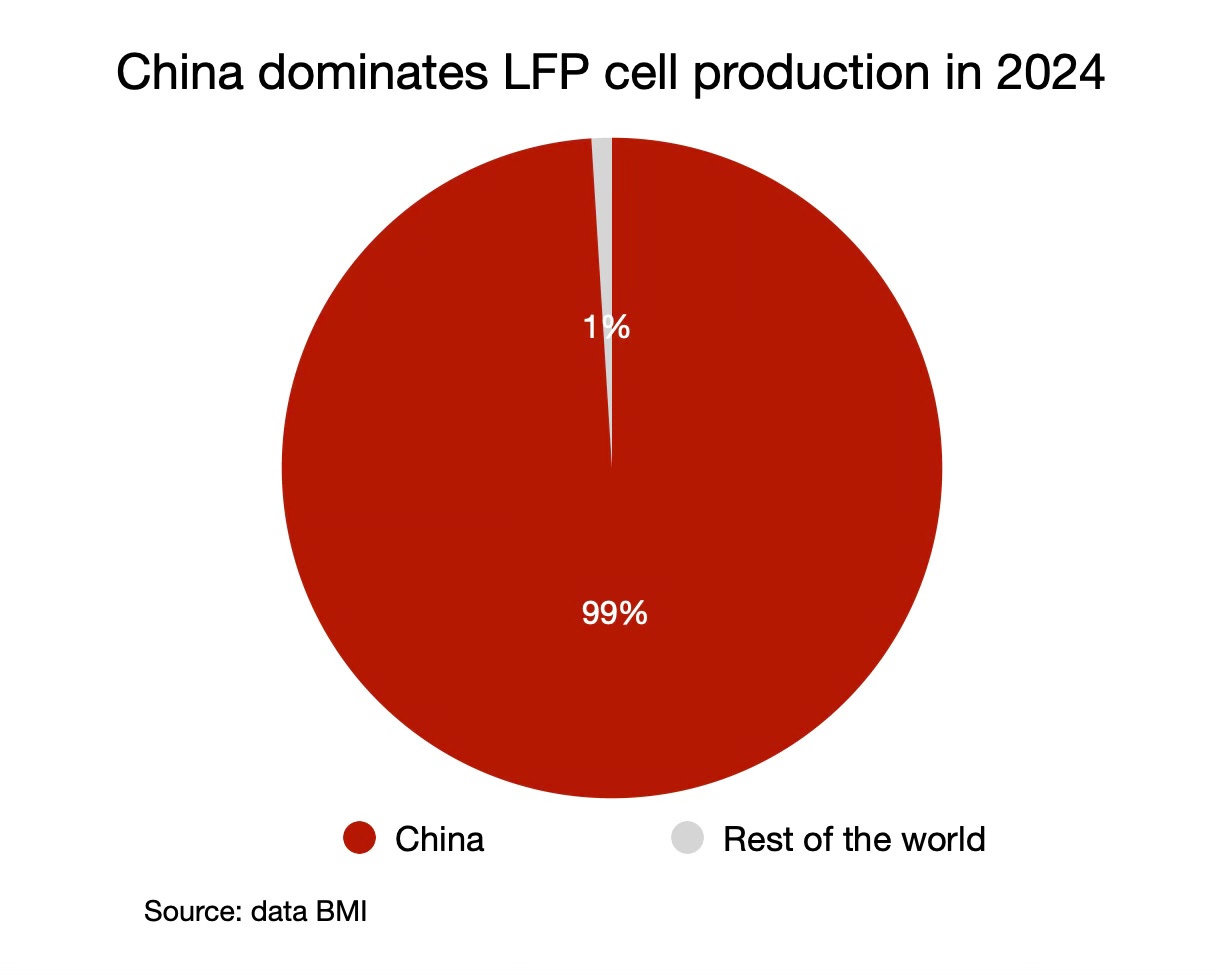

However, LFP batteries and cells are almost exclusively manufactured in China, further deepening the U.S. market’s reliance on Chinese supply chains for ESS deployments.

According to Rho Motion, over 90% of lithium-ion energy storage cells deployed in the U.S. storage market in 2024 originated from China, and they are primarily LFP cells.

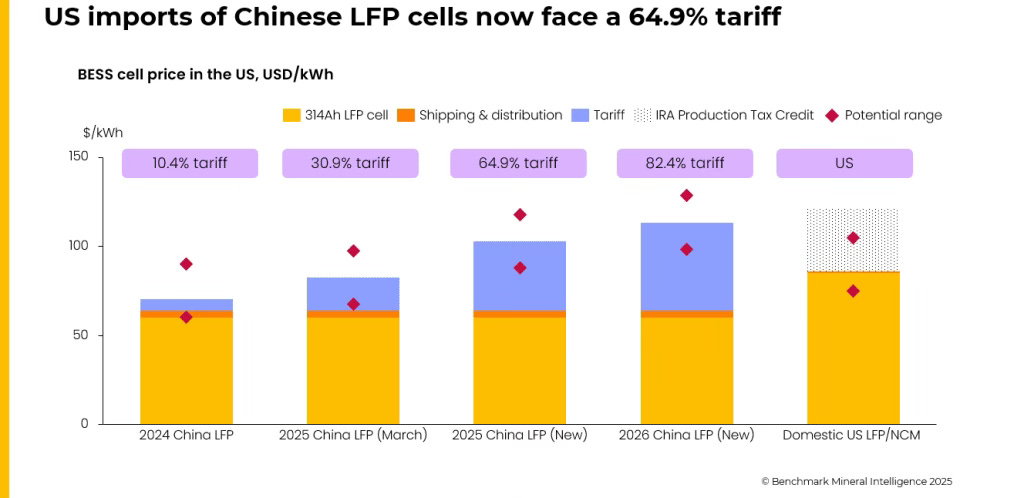

Under the new “reciprocal” tariff regime, Chinese goods will be hit with a 34% tariff, in addition to the previously announced 20% tariff, the 7.5% already applied to Chinese LFP cells for ESS, and the baseline 3.4% tariff. Altogether, this brings the total tariff on Chinese LFP cells to 64.9%, which is set to increase further to 82.4% in 2026 under pre-existing Section 301 tariff escalations introduced by the Biden Administration (Source: Rho Motion).

Not all goods will be affected. Key battery materials such as lithium carbonate, lithium hydroxide, cobalt sulphate, cobalt metal, manganese dioxide, and natural graphite (both powder and flakes) are exempt from these new tariffs.

However, several critical materials will be impacted, including nickel sulphate, manganese sulphate, phosphoric acid, iron phosphate, and synthetic graphite. These materials will fall under country-specific tariff regimes.

Notably, iron phosphate is an essential material in the production of LFP cells, meaning the new tariff structure could have a direct impact on the cost and competitiveness of LFP domestic battery manufacturing.

The price of LFP cells from China is expected to rise significantly in 2025 and 2026, from around $60-70/kWh in 2024 to over $100/kWh. This would bring prices back to 2022 levels, when lithium prices spiked.

If produced in the U.S., LFP domestic cells could be competitive thanks to the IRA production tax credit. However, as of now, no companies are manufacturing LFP cells domestically. LG Energy Solution appears to be the most promising candidate, with plans to produce LFP cells at its Michigan facility and a future plant in Arizona. That said, this competitiveness relies heavily on the continuation of the IRA tax credit, which President Trump could potentially eliminate.

In 2023, grid-scale installations in North America surged by 66%, reaching 40 GWh. Tesla alone generated $10 billion in revenue from its ESS segment. The company assembles Megapacks and Powerwalls in California, shipping them both domestically and internationally (e.g., Australia). However, most of the cells are sourced from CATL in China, making Tesla’s U.S. operations vulnerable to new tariffs. While its new facility in Shanghai may help supply non-U.S. markets, its profitability in the U.S. will be significantly affected.

These tariffs are set to impact the entire U.S. ESS market. I’ve already received a comment on my LinkedIn post from someone receiving more customers inquiring about alternative technologies such as supercapacitors.

This could pave the way for alternative technologies, like sodium-ion batteries, supercapacitors, flow batteries, and lead-acid batteries.

The goal of President Trump with these new tariffs is to reindustrialize the US. However, for the battery industry, the investments are already in the way thanks to IRA incentives.

Adding to the challenges, Reuters reports that the U.S. Department of Energy is considering cuts to billions of dollars in funding earmarked for pilot projects in emerging energy storage and carbon capture. The list includes planned funding reductions for six out of nine long-duration battery storage initiatives. These projects were collectively awarded $350 million to advance new technologies.

PS: I haven’t discussed the North American EV market, as there have already been numerous discussions on social media and covered by media. However, with the ongoing disruption in the North American automotive industry, the EV market is likely to face challenges. The rise in vehicle costs due to new tariffs and supply chain disruptions will make electric vehicles more expensive, potentially slowing adoption.

Now, let’s look at this week's battery market developments.

Battery Industry Pulse: Weekly Roundup

Raw Materials

Kodal Minerals nears commercial production at Mali lithium mine

Indian delegation to visit Chile seeking stake in SQM’s lithium projects

Australia's Galan Lithium declines $150m buyout bid for Argentine assets

Components

Battery

Tesla celebrates key milestone for 4680 battery cell production cost

Sion Power builds production line for lithium-metal batteries

Enovix To Acquire Korean Battery Cell Facility to Bolster Manufacturing

Siemens announces $150 million R&D battery facility investment in Canada

Battery Equipment

Battery Recycling

BESS

UK developer proposes $800 million, 1.6GWh big battery in heart of NSW coal country

US battery and carbon capture projects slated for cuts on DOE list

Passengers EVs

Charging infrastructure

Huawei to challenge BYD and Tesla with ultra-fast charger at 1,500 kW

CATL Joins Hands with Sinopec to Build Battery Swap Stations

Don’t hesitate to leave a comment or reply to this email to share your feedback. My goal is to make the best newsletter for you.