You were told battery swapping failed. China proved everyone wrong.

China didn’t kill battery swapping. It scaled it.

Summary

How China Turned a Failed EV Idea Into a National Infrastructure Play.

Battery Industry Pulse: Weekly Roundup.

Welcome back to another edition of my newsletter! - Week 25 2025

China quietly turned battery swapping into a big deal. On 1 May 2025, Chinese drivers swapped a battery every 0.6 seconds. A decade ago, swapping batteries seemed like a dead-end. Tesla ended its tests, Better Place went bankrupt, and most people moved on.

But China persisted. Today, battery swapping stations fill China’s big cities. The government invested billions, and companies like NIO, Aulton, and CATL are rapidly expanding.

China’s Battery Swapping Comeback

Since 2020, China's battery swapping market has experienced rapid growth. Strong government support, innovative business models, and strategic investments have driven this growth.

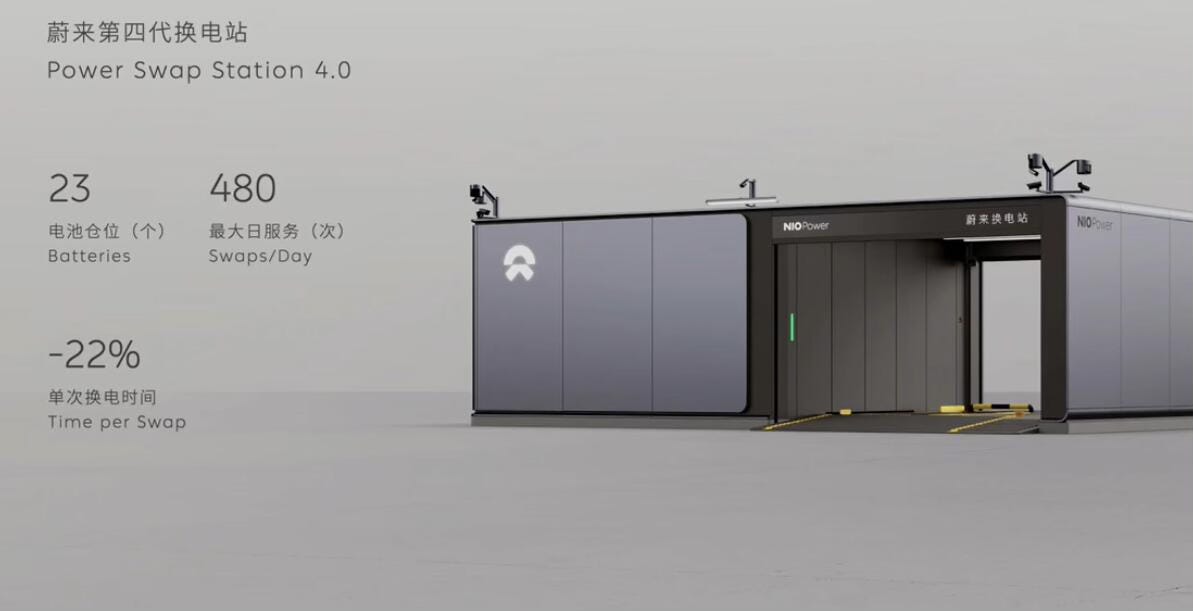

By mid-2025, China surpassed 4,000 battery swap stations. NIO accounts for 3,302 stations, followed by Aulton with over 800. These stations use advanced automation and robotics. NIO’s Gen-4 stations can complete swaps in just 144 seconds, becoming essential infrastructure in major cities like Beijing and Shanghai.

How NIO Became a Leader

NIO, a premium electric vehicle OEM, places battery swapping at its business core. Instead of purchasing an EV with a battery, owners pay less upfront and lease the battery from NIO.

NIO rapidly expanded its swapping network from 2,333 stations in late 2023 to 3,302 by May 2025. NIO stations completed over 73 million swaps by mid-2025, making swapping routine for many Chinese drivers.

In recent years, NIO has also established 60 swap stations in Europe, covering Germany, Norway, Sweden, the Netherlands, Belgium, and Denmark.

Fleets Love Battery Swapping

Battery swapping significantly benefits taxi, ride-sharing, and commercial fleets. Aulton New Energy specifically targets these segments. By mid-2024, Aulton operated around 800 stations, completing over 80 million swaps. The company claims each station can handle around 1,000 swaps daily in just 20 seconds, dramatically reducing downtime for fleet vehicles.

Commercial trucks are also adopting battery swapping. Geely’s Farizon brand operates 43-tonne swap-capable trucks, and CATL collaborates with SAIC on swapping for lighter commercial trucks. Depot-based vehicle cycles align naturally with swapping's quick turnaround model.

CATL recently partnered with Sinopec, China's state-owned oil giant, aiming to build 500 stations in 2025, eventually expanding to 10,000 stations nationwide. CATL’s standardized battery modules simplify swapping across passenger and commercial vehicle segments.

Government Policies and Standards

The rapid growth of battery swapping is heavily supported by the Chinese government. Government subsidies totaling around $2 billion strongly support the battery swapping infrastructure, especially in pilot cities like Beijing and Shanghai.

However, standardization remains a significant hurdle. China's GB/T 40032-2021 sets safety and size standards but doesn't mandate compatibility. Today, cross-compatibility is limited. NIO, for instance, remains proprietary, potentially limiting long-term growth.

Challenges of High Costs

High initial investment costs remain a critical challenge. Station costs ranging from 1.5 million to 3 million yuan ($200,000 to $415,000) each. Annual operating costs remain around $45,000, covering battery reserves, electricity, rent, and operations.

Low utilization initially hampered profitability. Industry estimates put average utilization at about 30-40 swaps/day in 2024. NIO’s stated break-even point of 60-70 daily swaps. However, utilization has risen significantly in urban areas. Most Shanghai stations now deliver over 100 swaps daily, moving these locations toward profitability.

According to analyst Qi Tianxiang’s team at Chinese brokerage Western Securities, NIO's battery swap business could break even by late 2026 if current growth continues.

Charging vs. Swapping: Both Needed

Rapid advances in fast-charging technology pose competition to swapping. CATL and BYD recently announced ultra-fast charging capable of delivering 400-500 km range in five minutes. These advancements could attract private car owners due to convenience and falling infrastructure costs.

However, swapping offers unique advantages for taxis, heavy trucks, and premium vehicles where downtime is costly. Swap stations also support grid stabilization. Over 1,700 NIO stations participate in virtual power plant (VPP) programs, providing flexible grid capacity.

Ultimately, swapping and charging are complementary solutions rather than competing alternatives.

China’s Global Influence

China’s battery swapping model could influence global EV infrastructure significantly. By 2030, industry forecasts range from tens of thousands of stations (optimistic scenario) to modest incremental growth, depending heavily on standardization mandates and consumer acceptance.

China’s battery swapping revival illustrates how previously overlooked technologies can find renewed success under the right conditions. However, the sector faces two strategic dilemmas:

First, who underwrites long-term investment? Currently, oil and state-owned entities are critical financiers, but sustainable profitability remains uncertain.

Second, standardization will determine whether battery swapping remains niche or achieves true scale. Proprietary systems may deliver short-term competitive advantage but risk isolation if national mandates shift toward full interoperability.

Navigating these strategic decisions will determine whether battery swapping remains a localized success story or becomes a global standard for electric mobility.

Now, let’s look at this week's battery market developments.

Battery Industry Pulse: Weekly Roundup

Metals

Euro Manganese Joins Forces with IPL in Strategic Battery Supply Deal

Electra Battery Materials begins build to restart North America’s only cobalt sulfate refinery

Battery

BYD is testing solid-state EV batteries in its Seal sedan with nearly 1,200 miles of range

Factorial presents AI platform ‘Gammatron’ for battery development

Chinese aviation company EHang picks Gotion High-Tech as preferred battery supplier for air taxis

Chery to be supplied with 46mm cylindrical cells from LG Energy Solution

Battery Recycling

Passengers Cars

Commercial Vehicles

Charging Infrastructure

Policy

🤝 For newsletter sponsorships - Click here

Battery swapping was possibly viable when charging speeds were low. Now I drive for two hours, get a coffee and use the toilets while the car gets another 100 miles of range. There are far more 24/7 charging locations then there will ever be battery swap locations and there will never be a situation when there are no charged batteries to be swapped. We have a charging infrastructure. Where is the battery swapping infrastructure?

# On Battery Swapping: Where It Works and Where It Doesn't

I remain skeptical of battery swapping for passenger cars. NIO's finances appear dire, and while CATL might invest heavily—hoping to corner the market through platform standardization—the economics remain questionable. Swap stations are simply too expensive.

Battery swapping makes perfect sense for 2/3 wheelers. Small batteries mean cheap swap stations, local networks can scale gradually, and these vehicles rarely need highway infrastructure. The model has already taken off across Asian markets—India, Indonesia, and Taiwan.

Commercial trucking presents another viable application. Downtime carries high opportunity costs, making swap stations economically justified. In Australia, given our vast distances and the world's largest trucks, this model seems inevitable.

Mining trucks targeting full electrification within ten years remain an open question—whether through battery swapping or high-speed charging is unclear.

What's your view on overhead charging cables for highways? Europe and India are trialling them for commercial trucks. Are there Chinese experiments worth noting?