Battery cell production in Europe: the latest shifts and challenges

Every week, the battery landscape shifts in fascinating ways — this one is no different.

Welcome back to another edition of my newsletter! - Week 8 2025

In this new edition, we are examining the current European battery cell landscape. The race to establish a strong European battery cell industry is facing serious hurdles.

Summary

Special topic: European battery landscape

Battery Industry Pulse: Weekly Roundup.

Special topic: European battery landscape

Recently, two battery cell projects were canceled in the USA, and a similar trend is emerging in Europe.

As the EV market has expanded, numerous battery cell plant projects have been announced across Europe over the past 5-6 years. To support these initiatives, European countries have invested heavily in subsidies.

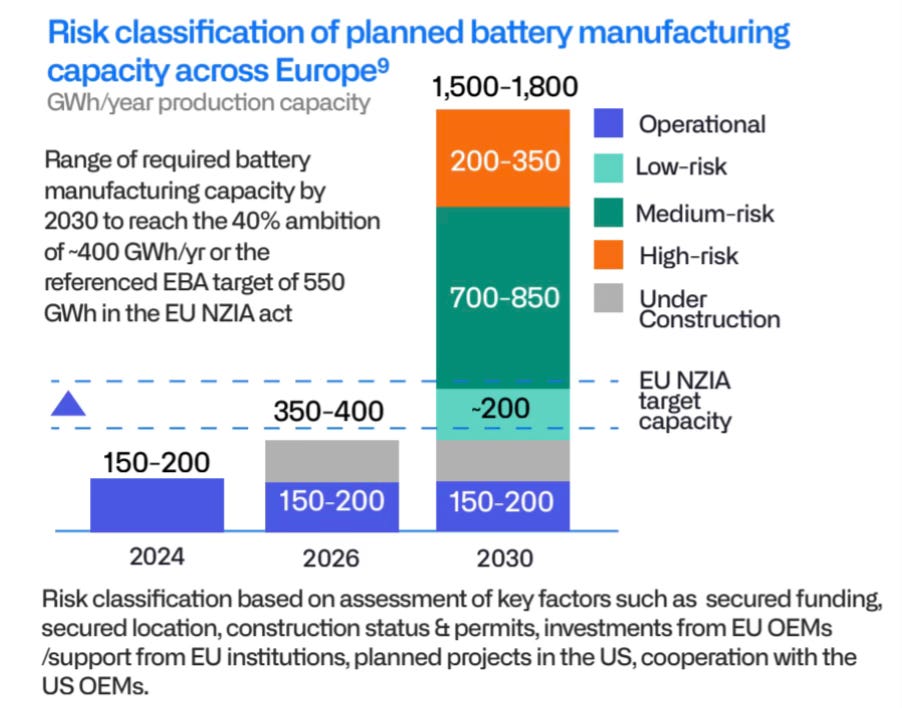

By 2030, the total projected annual capacity of these plants was expected to reach approximately 1,500-1,700 GWh. However, in recent times, several projects have been either canceled or put on hold.

Nigel Taylor, Founding Director of BatteryDesign.net, has recently made an update on the European cell projects:

Seventeen projects have been canceled or paused, with only one new project announced, a joint venture between CATL and Stellantis.

More projects are likely to fail due to a lack of operational experience.

According to these companies, the main reasons for cancellations or delays include:

EV market slowdown. - I disagree. While the market has indeed slowed in 2024, battery cell projects are long-term investments..

Competitiveness of European subsidies compared to those of the USA.

Cell price gap with China. They have a point. Even after factoring in shipping and tariffs, Chinese battery cells remain cheaper in Europe.

Energy prices are a significant challenge. I agree that high energy costs in Europe make the continent less competitive in battery cell production. Lowering these costs will be essential for Europe to remain a strong player in the global market.

I would also consider factors such as production ramp-up challenges (e.g., Northvolt), high-risk company profiles, and lack of expertise (e.g., Freyr)….

Of the 1,500–1,800 GWh in announced capacity, a significant portion is at medium to high risk. It's correct. As mentioned earlier, several projects have already been canceled or put on hold:

Europe currently has an annual battery cell production capacity of around 200 GWh, primarily driven by well-established companies such as LG Energy Solution, SK On, Samsung SDI, AESC Envision, CATL...

The EU’s battery demand is projected to reach approximately 800-1,000 GWh by 2030, depending on the consultancy. According to CRU’s Battery Report 2024, Europe produced 122 GWh in 2024, leaving a significant gap to close within the next five years.

Roland Berger estimates that a realistic capacity for 2030 is around 740 GWh, far below the initially announced 1,500–1,700 GWh. Given the challenges ahead, I expect that well-experienced companies will successfully execute their projects and drive the main growth in Europe. For example, CATL is currently ramping up its cell production in Germany. It's great news.

=> A must-have for Europe.

When it comes to building European champions, Northvolt, ACC, and PowerCo stand out as the strongest candidates. ACC and PowerCo have the financial backing to survive and scale, but expertise remains a crucial factor. Money alone won’t guarantee success. Despite Northvolt’s struggles, I genuinely hope they succeed, as Europe needs more homegrown battery companies.

=> A nice-to-have for Europe.

As for other European startups, most will likely face significant challenges, including financing, expertise, talent acquisition, and technological development. However, there are exceptions. One promising example is ElevenEs, a Serbian LFP battery cell producer, which is progressing steadily to master cell production.

I believe European startups are best suited for upstream activities and battery recycling, where they can add the most value through collaboration with battery cell manufacturers.

Despite these challenges, Europe has the potential to build a competitive battery cell production landscape. According to CRU, Europe can close the gap with China through automation, lower electricity costs, reduced lithium prices, and production optimization. It won’t be easy, but it is possible.

Let’s have a look at an optimised LFP cell production in Europe:

For Europe to succeed, I strongly believe in collaboration. Joint ventures are an effective way to de-risk projects and facilitate technology transfer.

In the U.S., most battery cell projects are joint ventures between Korean battery makers and OEMs. In contrast, Europe has relatively few such partnerships. However, there’s promising news. Stellantis recently announced a €4.1 billion joint venture with CATL to produce LFP cells in Spain.

Key takeaways:

Northvolt, ACC, and PowerCo have the strongest potential to become Europe’s leading battery champions.

Established battery makers (LGES, CATL, SK On, EVE Energy, Samsung SDI…) are best positioned to drive the growth of the European battery industry.

Most lesser-known startups will likely fail before even reaching the construction phase.

Europe can be competitive in battery cell production by prioritizing automation and reducing electricity costs.

Europe can de-risks projects through collaboration. I am fan of joint ventures.

If you interesting more on the topic, I recommend these two reports:

Battery Monitor 2024-2025 from Roland Berger and Aachen University - link

CleanTech for Europe, Reality Check - link

Also, if you want to know the reasons why the Western companies are struggling in the battery industry, I wrote an article two weeks ago.

Inside the collapse of Western battery startups – key mistakes revealed

Welcome back to another edition of my newsletter! - Week 6 2025

Now, let’s look at this week's battery market developments.

Battery Industry Pulse: Weekly Roundup

Metals

Components

Daejin Advanced Materials to build CNT material production facility in North America.

Battery

StoreDot plans to build its XFC batteries with a partner in South Korea.

Renault opens ‘Fireman Access’ patent to all brands to help reduce EV battery fires.

BYD expects to begin 'demonstration use' of all-solid-state batteries by 2027.

BESS

Passengers EVs

Italy investigates Stellantis, Tesla, VW and BYD over EV consumer info

SAIC Motor, Huawei forge partnership to co-build smart new energy vehicles

Charging infrastructure

Don’t hesitate to leave a comment or reply to this email to share your feedback. My goal is to make the best newsletter for you.

What's your thoughts on Enovix